Is ULIP better than mutual funds? Read this essential guide to know the difference between mutual funds and ULIP, before you invest your hard-earned money.

The burning question is, “Where should I invest – ULIP or Mutual funds?”

If you are confused with the same dilemma, then this post is just for you. For you, to know, to learn, and to decide - where to invest. To make the right investment choice without regrets. This article focuses on the comparison between ulip and mutual fund and help you in doing the right investment.

A sound financial planning is all about the balancing act. It is about investing in the right product at the right time to reap the maximum benefit.

Do not worry if you are thinking: "Is ULIP better than Mutual Fund?" or "Is Mutual Fund is better than ULIP?"

Before you decide, let us first clearly understand what ULIP and Mutual fund stand for, and how each differs from the other.

What is Mutual Fund?

Generally, whenever, one thinks of investing money, the most spontaneous response is mutual funds. Because mutual funds are one of the oldest and common investment instruments for investors looking for gains.

Here’s how mutual funds works:

You – the investor invests money in a mutual funds which runs with the support of a trustworthy fund manager.

Fund Manager – Collects funds from different investors like you.

Mutual Fund Scheme – Mutual funds are investment schemes - from where you can expect to gain returns. The collected amount of money from different investors is then invested in a well-calculated and researched based scheme to generate returns. This is further distributed among the individual investors. In short, mutual funds are purely investment opportunities to earn good returns.

Types of Mutual Funds: There are various options, which includes equity funds, liquid funds, debt funds, money market funds, hybrid funds, tax-saving (ELSS) funds, and many more.

Benefits of Investing in Mutual Funds

Maximum Returns: There is a potential of high returns. Investment in equity and hybrid funds have a higher potential of high returns. Ideally, investors looking for short or medium term investment products invests in mutual funds.

Track Record : Mutual funds have been in the market since long, because of which, market trends are available to the investors. Here, the investors can track the performance records before investing. Long history of scheme allows to make right decisions.

Liquidity: Very liquid, one can invest and exit at any time, except in the case of ELSS. Basically, there is no lock-in period, except for ELSS funds which have a 3 year lock-in period.

What is Unit Linked Insurance Plan (ULIP)?

Do not be confused with mutual funds and ULIPs. Because they do have a few similarities, however, they are different financial products. ULIP is a unique and strategic financial product, which is a combination of life insurance and investments.

In ULIP, a part of the premium is deducted as mortality charges for providing life cover. The other part of the premium is invested in different funds based on the risk appetite of the investor.

ULIP fund allocating options: The funds where your money could be invested are bonds, equities, debts, market funds, or hybrid funds - depending on the investor.

Benefits of Investing in ULIP

Life Cover : The life insured is covered against the risk of an untimely death. There’s an assured death benefit that is payable to the nominee in case of an untimely death of the life insured. If there’s a rider attached to the ULIP, the nominee receives the rider benefit also. However, the death benefit is usually, the higher of sum assured or the fund value.

Tax Savings: Premiums paid towards the ULIP are tax-free under Section 80C of the Income Tax Act, 1961. The payout received by the nominee is also tax-free under Section 10(10D) of the Income Tax Act, 1961.

Add top-up to your base plan: ULIP gives an opportunity to increase your base plan coverage and investment fund. Top-up is a one-time lump sum investment you can pay over and above your premiums. You can avail this facility anytime during your policy term. It is an optional feature of ULIP. This additional amount paid through top-up gives you an advantage to increase your sum assured, and amount as an investment.

Let us discuss about the difference between ulip and fund.

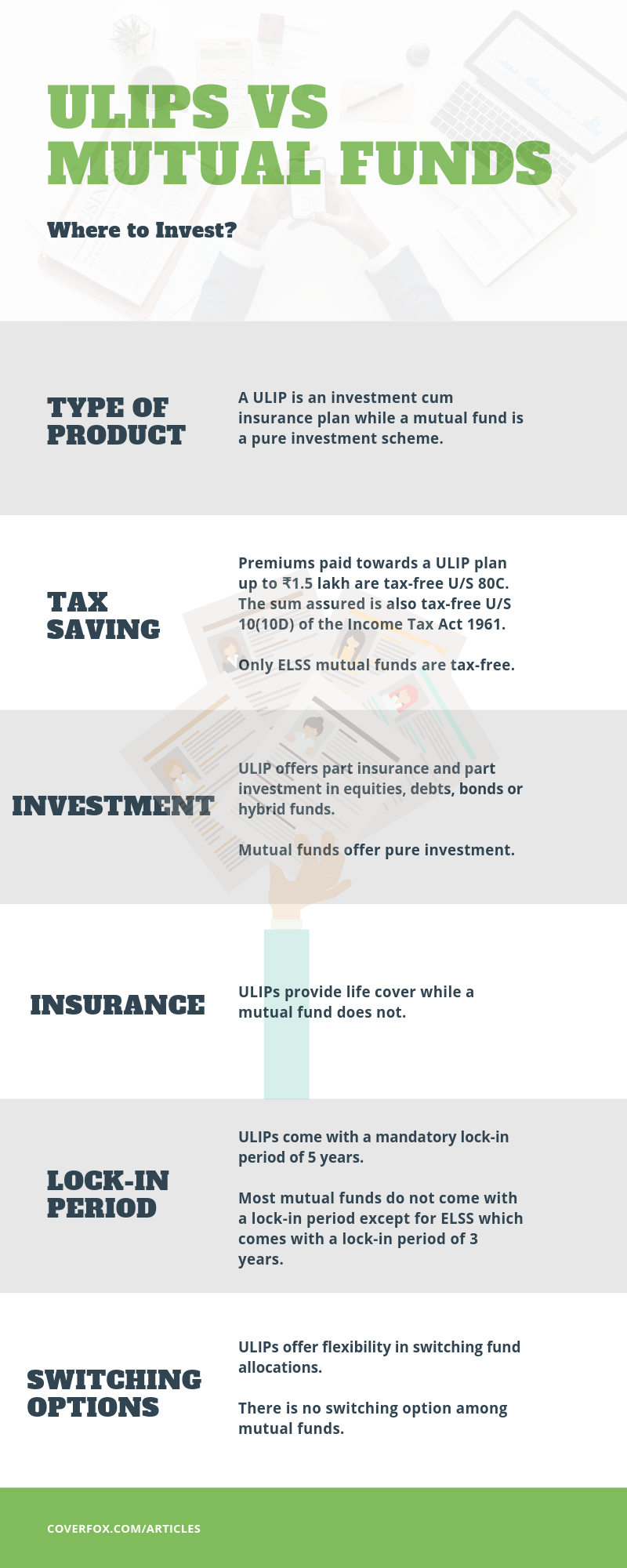

ULIP vs Mutual Funds: Difference Between ULIP and Mutual Fund

| POINT OF COMPARISON | ULIP | Mutual Fund |

|---|---|---|

| Type of product | Insurance + Investment. | Only Investment (no life coverage). |

| Tax-savings | Premiums paid towards the plan up to Rs.1.5 lakh are tax-free under the Section 80(C). The sum assured paid to the nominee would also be tax-free under the section 10(10D). | Only ELSS based investments are tax-free up to Rs.1.5 lakh are tax-free under the Section 80(C). |

| Investment | Part insurance – life cover and part invested in equity, hybrid, debts, bonds, equity, etc. | Pure Investment. |

| Insurance | Life cover is provided. | No Life Cover |

| Riders | Option to get comprehensive and complete protection by adding riders | Not Applicable |

| Returns | Chances of moderate to high returns Net Asset Value (NAV) depends on the type of investment funds and on the performance of market. | Chances of high returns. Equity oriented investment gives high returns. Depends on the allocation of funds and market performance. |

| Liquidity | Need to wait until completion of the lock-in period i.e. 5 years before exit. | More liquid, except with ELSS which have a lock-in period of 3 years. |

| When to consider buying | When you want to provide financial security, and at the same time ready to accept investment risk. | When you have disposal money and wish to gain high returns of sum. |

| Tenure | Depends on the investor but for good returns on investment – 10 to 15 years. | No specified tenure |

| Ideal Term | Long term. | Can be short, medium or long term. |

| Ideal Time to buy | Can be bought anytime depending on the requirement and amount one wishes to save. | When one has less financial burden and have disposal money. |

| Switching Options | Flexibility in switching fund allocations. | No switching option |

| Lock-in Period | 5 years | Most of the mutual funds typically do not have any lock-in period, except ELSS which have a lock-in period of 3 years. You can buy and sell mutual funds anytime, closed funds. |

| Security | Moderately Secure | Not Secure |

| Fund Management Charges | Higher in the initial years up to 5 years, and later on 1.35% | Charges are 2.5% |

ULIP vs Mutual Funds: Which is better?

It depends. It depends on your risk appetite, your needs, dependent family members, and so on.

Ask yourself these simple questions:

- Do you have financially dependent family members?

- If yes, then what’s the number of these dependents and how long will they take to be financially independent?

- What is your risk appetite - low, medium, or high?

- What is your financial goal - want immediate returns, want to save money, tax savings planning, or looking for financial aid for your family?

- Do you have a life cover?

- How long you want to stay invested - short-term or long-term? Once you analyze your needs and current situation, you may find what works best for you.

In short:

Go for Mutual Funds:

- When you want returns in short or medium term

- When you have low, medium or high risk appetite

- When you want your investment to be liquid or easily free your money (except, ELSS)

- When you already have a term life plan to protect your family financially

Go for ULIP:

- When you are looking for a long-term investment plan

- When you have a low, medium or high risk appetite

- When you want a life cover along with investment to provide financial support to your family in case of unfortunate eventualities

- When you want a financial vehicle to help in saving tax

ULIP vs Mutual Fund - Where to Invest?

Both, ULIP and Mutual Funds are different products serving different purposes.

However, if you are looking for a systematic approach to have both insurance and investment then, then you have two options to play the game of investment in the right way:

Option 1: Low Charges ULIP

Earlier, up to 2010, the charges involved in ULIP were higher. But, post 2010, the fund management charge, premium allocation charges, mortality charges, etc. have been reduced to a far lower percentage than earlier. This reduction has made ULIP a good investment product.

When you buy ULIP online:

You save a lot on various charges including agents' commission. These various small savings turn into big savings overall, which are passed on to policy buyers.

Fund management fee – You are now charged in the range of Nil to 1.35%

Premium Allocation charge – Nil or lower than previous version of ULIPs

Policy Administration charge – Nil or lower than previous version of ULIPs

Mortality Charges – Varies with age

However, you should note that in ULIP, the life cover you get is 10 times of your premium. For instance, you opted to pay a premium of Rs.20, 000 per annum. You will get a life cover of Rs.2 lakh.

Option 2: Term Insurance + Mutual Funds

One way to combat the ups of low charge ULIP – providing life cover and investment opportunity, which most of the financial pundits suggest is:

To have a term plan - a pure insurance product that offers high life cover at a very reasonable premium. You can opt for a term insurance plan with a life cover, which can be up to 15 - 20 times of your annual income. Let’s say, your annual income is Rs.5 lakh, you can opt for a life cover of up to Rs.1 crore (20 times of your annual income).

Invest money in mutual funds - purely investment product that give high returns, and sometimes, even in a short span.

With a term plan, you have an adequate life cover to provide financial protection for your family. Moreover, you get the same tax benefits as with a ULIP.

Read to to get a quick comparison between ULIP and Mutual Funds

Suggested Reading - Term Insurance vs ULIP: What Makes More Sense?

If you still have any queries, just hit your questions to us in the comments. We will be more than happy to help you.

Happy investing!