Non-communicable diseases (NCDs) account for about 66% of all deaths in India (Ministry of Health and Welfare).

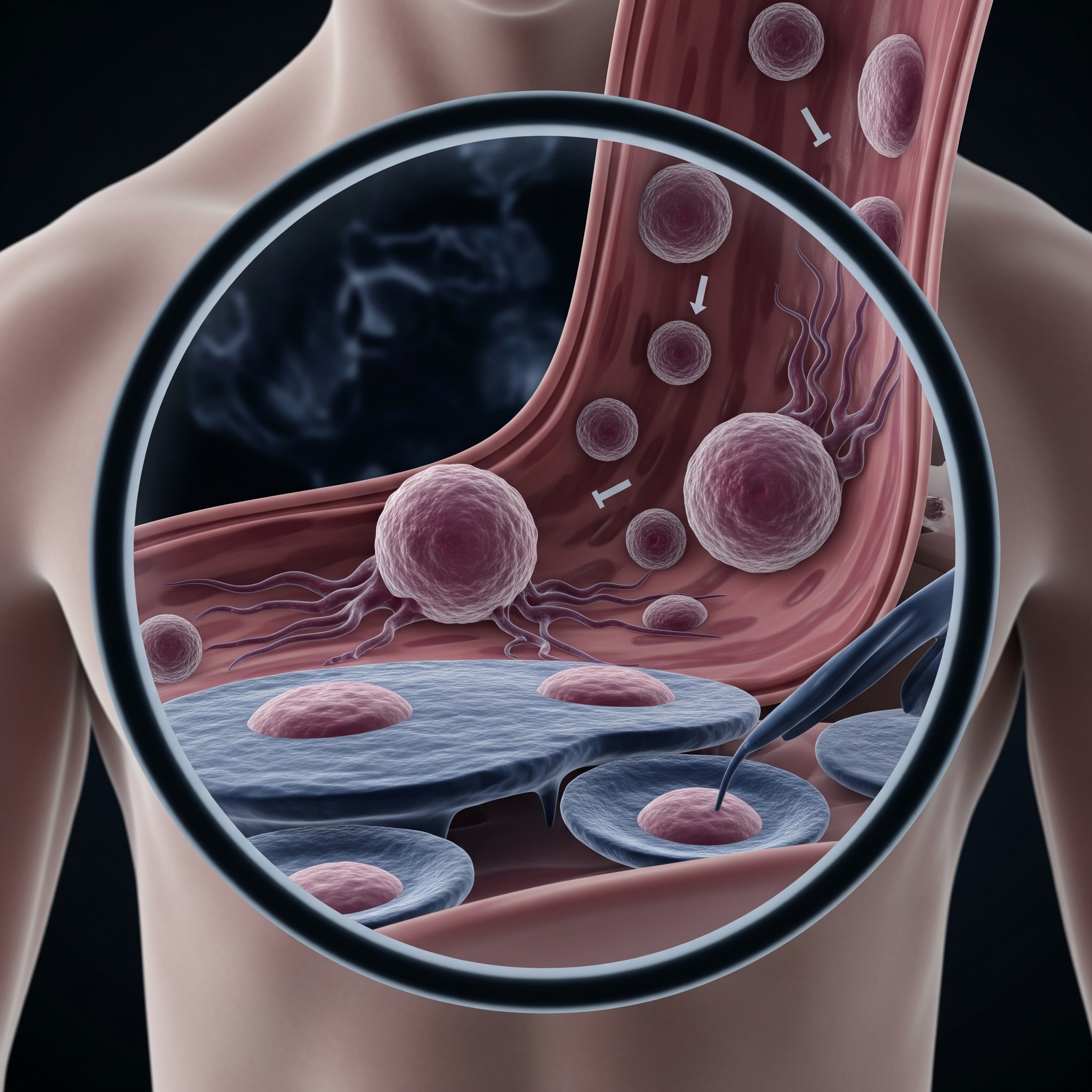

The major contributing NCDs are cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes.

Approximately 90 million people in India are living with diabetes, and 15.3% of the population has prediabetes (Department of Biotechnology, Ministry of Science and Technology).

According to a 2024 Ipsos report, cancer (47%), obesity (28%), and mental health (26%) were the top health concerns among Indians. A study in The Lancet (July 2024) linked air pollution to 1.5 million deaths per year in India, based on exposure levels higher than WHO recommendations.

According to a NITI Aayog report, approximately 30% of the population, or 40 crore individuals, are without any form of health insurance.

Households in India still bear nearly 47% of total medical costs from their own pockets, which can push families into poverty.

Access to TB treatment and coverage in India increased by 32% in last eight years from 53% in 2015 to 85% in 2023 (Ministry of Health and Family Welfare).

Deaths due to malaria rose to 3,500 in 2023 (Ministry of Health and Family Welfare).

In 2024, India reported over 230,000 cases of dengue, accounting for a significant portion of the global burden (National Centre for Vector Borne Diseases Control).