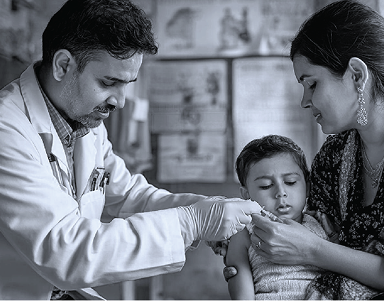

Affordable Healthcare for Rural Communities The Sehat Suraksha plan offers affordable, comprehensive healthcare protection designed for rural communities. It safeguards against sudden accidents and health risks, offers comprehensive coverage in a single plan, helping to reduce the financial burden of hospitalization and making healthcare more accessible, secure, and reliable. Coverfox is proud to drive this initiative across partner institutions and look forward to growing this movement because protection shouldn't be a privilege, it should be a promise — for all of Bharat.

Sehat Suraksha Bima

Get protection against accidents, critical illnesses, and hospitalization with coverage benefits up to ₹1,85,000* across 5 different packs

Multiple coverages

Get protection against accidents, critical illnesses, and hospitalization with coverage benefits up to ₹1,85,000* across 5 different packs

Multiple coverages

in one ₹499 plan

Simple, visual

brochures for clarity

100%

claim assistance

Why Choose

Sehat Suraksha Bima?What's Included in Your

₹499 Plan

Sum Insured

₹1,00,000

Accidental Death Permanent Total Permanent Partial Disability

Sum Insured

₹50,000

Critical

Illnesses

Sum Insured

₹10,000

Cover for

Snake/Animal bite

Sum Insured

₹10,000

Mosquito - Borne Diseases

Sum Insured

₹500/day

Hospital Daily Cash Benefit (up to 30 days)

Important Terms & Conditions

General Eligibility

This insurance plan is available to individuals aged 18-60 years. All applicants must be residents of India and meet the basic health requirements as specified in the policy document.

Terms and Condition Of The Product

The policy covers accidents, critical illnesses, hospitalization, and specific conditions as mentioned. Waiting periods apply for certain conditions. Claims must be filed within 30 days of the incident. Pre-existing conditions are subject to specific terms. Please refer to the complete policy document for detailed terms and conditions.

Need Any Help?