Hold on! Don’t blow out the candles on your birthday cake just yet. If you do not have a term insurance plan protecting yourself, it is best to wish that you could go back in time and wish you had bought it before and saved 6% on your Term Insurance Premiums.

"Age is just a number, you are as young as your mind feels", we have heard this many times and many of us even believe in it. But, this cannot be held true for a term insurance plan. If you miss out on buying a good term insurance plan, you could be paying around 6% more on your term insurance plan premiums for every year of delay. The reason is plain and simple, the term insurance premium is directly related to your age.

Why Term Insurance?

Term plans are an important part of growing up in life and making arrangements for your loved ones. They ensure that your family does not have to make compromise after the sole breadwinner is not around anymore. It helps at every stage of life and the best time for buying the same was YESTERDAY. It's the only way of protecting your family so that they can survive the many ups and downs of life in your absence.

Will the delay cost me?

YES; be it a severe illness waiting around the corner of life or a freakish road accident lurking in the shadows, which derails your plans for your family's future.

The clock starts ticking the moment you get your very first salary cheque in your hands and you officially start earning income, you need to protect every rupee you earn. At this juncture of your life, a term plan becomes the answer to all those wishes you made while blowing the candles on your birthday cake. But, if you delay buying it, the premiums on that term insurance plan are going to rise and you could end missing the opportunity of savings of around 6%. Read on to know how:

Premiums rise with Age: There is no debate on this point, the younger a person is, the healthier he is physically and mentally. Just like my colleague, he gifted himself his very first term life insurance plan on turning 30 for a cover of Rs. 50 Lakhs at just Rs. 415 per month (Rs. 4,720 per annum inclusive of all applicable taxes) for a term of 30 years. Isn't it great that you get a cover of Rs. 50 lakhs for Rs. 13.80 per day? Which turns out to be even less than the cost of his daily tea and snack.

Had he delayed his decision of giving himself this wonderful gift by just one year, his premiums would have increased to Rs. 441 per month (Rs. 5015 per annum inclusive of all applicable taxes) an increase of around 6%.

As the no. of candles on your birthday cake increases, so are chances of you getting the devil's gift of critical illnesses like cancer, diabetes, heart ailments for the lifestyle you live. Even if you are working a stress-free life and have a sedentary working life of a 9 to 5 job with weekly offs, it does not make you immune from receiving these lifestyle gifts.

Like, if he had decided to postpone his decision by say another 4 to 5 years and had tried purchasing it at the age of 35 he would have been paying an even bigger amount of Rs. 561 per month (Rs. 6372 per annum inclusive of all taxes)

A term insurance plan's premium depends on the amount of risk a person brings to the pool. The older the person is while entering the pool, the higher is the risk. Whereas on the other hand, a younger person is almost risk-free unless you take into account the freakish accidents which life might have a planned for each and every one. They attract a lower premium rate, and by paying just a few thousand rupees or even less, they can get a term life insurance cover worth lakhs of rupees or even more.

If the same person decides to postpone his buying decision by waiting, say a few years, he risks attracting a high premium payable by him down the line. It can also be possible that the wait has already made the critical illness his partner for life. This may result in the insurer rejecting his policy application altogether or drastically increase your premiums by loading the premium payable by him to offset the additional risk he is bringing with him.

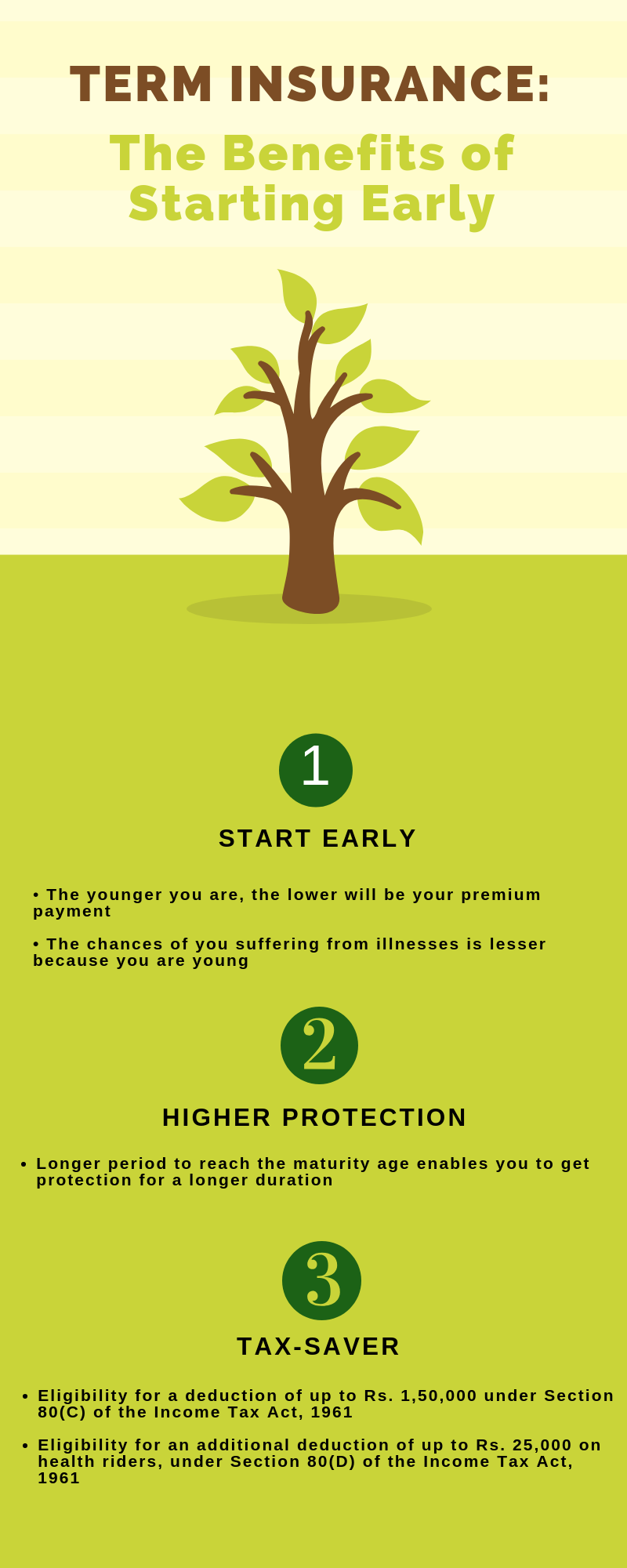

Other Benefits of Buying Early

Longer Period of Protection: You are not only saving 6% on your term insurance premiums by buying a term plan at an early age in your life but are also getting financial protection for a longer period of time for your loved ones. Almost all term life insurance plans have a pre-determined maturity age, beyond which the cover is not provided. Suppose a 33-year-old male wants a term insurance plan, the maximum age till he can get the same is for a period of 40 or 50 years or till the maximum maturity age 85 years depending on the insurer. In this case, he will be provided for a maximum term of 50 years and not till he attends the age of 85 years.

As his age grows, he will start getting closer to the maximum maturity age and so the term will keep decreasing. The delay in the buying process will shorten the duration, and let's be honest each and every one wants to provide the maximum protection to their family for the longest possible period.

Golden Opportunity to Save Tax: The bonus of having a term insurance apart from the awesome protection that you get is the tax benefits you get with it. We all love to save on our tax outgo wherever possible. It is the same anxiety for all whether you're have just started earning or have been doing it a couple of years, there's no greater joy than saving your hard-earned money from the tax axe. Term insurance plans can help you do that while providing financial protection to your loved ones in your absence.

The premiums that you pay towards your term insurance plan offer you tax deductions of up to Rs. 1,50,000 under Section 80(C) of the Income Tax Act, 1961. Thus, your total taxable income can be reduced by an entire Rs. 1.5 Lakhs. Plus, if your term insurance also has health riders attached to it, you are eligible for an additional deduction of Rs. 25,000 under Section 80(D) of the Income Tax Act, 1961.

The tax benefits don't stop just here, they continue even while you are gone forever. The death benefit paid by the insurance company to your loved ones is completely tax-free under Section 10(10)D of the Income Tax Act, 1961 provided the annual premium paid is less than 10% of the sum assured.

Don't wait, the time to Act is now

It is best if you let your wisdom grow with your age, but not your term insurance premiums. A Term Life Insurance Plan is only a pure protection plan that should be purchased without fail and that too at the earliest possible. You can then enjoy the unmatched benefits of comprehensive protection + tax savings + economical premiums. To top it up, a term plan bought at an early age gives you a good savings of around 6% or more on your premiums.

Here are some of the benefits of getting a term plan early in life

.jpg)