Congratulations! You have made the right choice by selecting a term insurance plan to provide a financial protection to your family. There is just one question that remains to be answered, "Does your term plan take care of all your insurance needs?" You can never be truly satisfied until you know the answer to this question. Read on to know more about it . . .

There is an old saying "Always Expect the Unexpected from Life." Confused, you should be because life itself is full of unexpected twists and turns. You are always prone to risks like critical illness, hospitalisation, accidental disability, death. This makes it important for you to look beyond the traditional need of just a pure term cover.

The chances of contracting a critical illness at any stage of your life can never be ignored. During such times, it becomes difficult to meet the exorbitant medical expenses. If you are the only earning member of the family, critical illness can push your savings down south. Financial worries can also impact your chances of recovery.

The answer to this dilemma is very simple, attach a Critical Illness Rider to your basic Term Insurance Plan.

So, the big question is, "What is a Critical Illness Rider?"

A critical illness rider is an add-on protection that you can attach to your term insurance plan. In case you are diagnosed with a critical illness, the rider cover amount is paid to you.

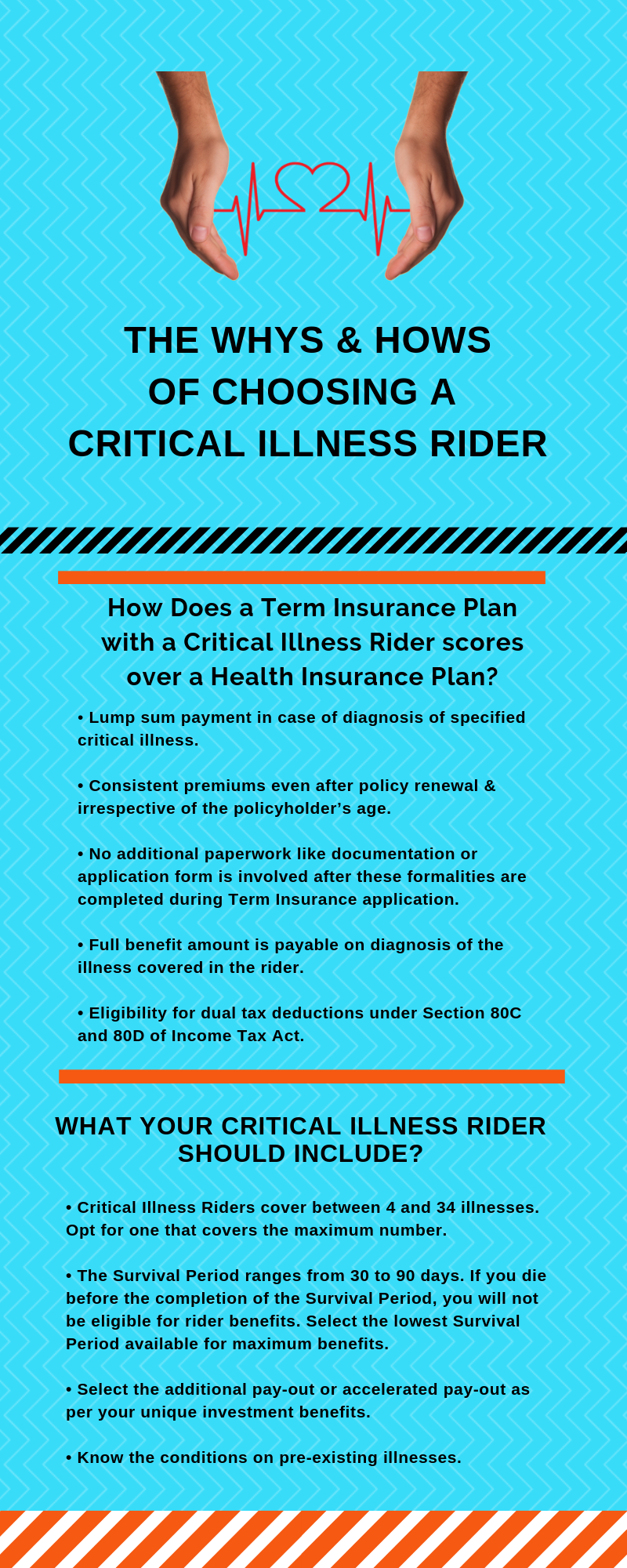

This brings us to the next question, "Why a Critical Illness Rider and why not a health insurance Plan?"

There is not one, but 5 reasons for getting a Critical Illness Rider:

1. Lump Sum Payment: On diagnosis of the covered critical illness a lump sum benefit is paid. This financial support will help you in both hospitalisation and non-hospitalisation expenses. The money received helps put your mind at ease about the medical expenses involved. Relaxation and proper medication are the best tools for a faster recovery.

2. Consistent Premiums: This major feature tips the scales in favour of critical illness riders when compared against Health Insurance Plans. The premiums for Critical Illness Rider will remain the same throughout the term, whereas the premiums for health insurance Plans would change every year on policy renewal which is based on your age.

3. No Medicals: Adding a critical illness rider to your base term insurance plan is very simple. It is just like asking for additional toppings on your favourite pizza. There are no additional medicals or application form or any additional paper work involved. The medicals and documentation that you undergo for your term plan are sufficient for getting covered for the Critical Illness Rider also.

4. Bye-Bye Deductions: Another major benefit is that on the diagnosis of the covered critical illness, the entire benefit amount is paid in full. There is no capping, no sub-limits, no deductions, you get the entire coverage amount on the first diagnosis of any of the covered critical illnesses unlike as in the case of a health insurance plan. If your critical illness rider cover is say for Rs. 50 Lakhs, the entire amount is paid to you in full.

5. Double Tax Benefits: Premium paid is eligible for deduction under section 80C & section 80D (the overall limit of deduction for investment u/s 80C & u/s 80D of the Income Tax Act, 1961 are Rs. 1,50,000 & Rs. 25,000 respectively, subject to conditions mentioned therein).

It is also extremely important to know about these crucial points before choosing a Critical Illness Rider:

1. Critical Illnesses Covered: Obviously, one must always consider the rider that covers the maximum number of critical illnesses. The more the merrier is an apt statement for this. In today’s market scenario there are critical illness riders which cover critical illnesses ranging from 4 to 34.

2. Survival Period: After the diagnosis of a critical illness, the policyholder is required to survive at least for a few days. If the policy holder dies before completion of survival period, no payment is made against the rider. Hence, it is always advisable to choose a rider with lowest survival period. The survival period offered under various critical illness riders available in the market ranges from 30 to 90 days.

3. Accelerated Pay-out or Additional Pay-out: This is another crucial point that needs to be considered before choosing the critical illness rider. It is very important to know about each pay-out option:

Accelerated Pay-out: Under this pay-out type, a part of the base cover is paid. Say, your term plan has a cover of Rs. 1 Crore and Critical Illness rider cover is of Rs. 30 Lakhs. On diagnosis of the covered critical illness, Rs. 30 lakhs will be paid from the base cover of Rs. 1 crore. Now, after a period of 6 months, you are not able to survive the critical illness, then your nominee will receive only Rs. 70 lakhs as Rs. 30 lakhs was already paid to you.

Additional Pay-out: This pay-out type is the exact opposite of Accelerate Pay-Out. Under this, the critical illness rider cover amount is paid over and above the base cover benefit. So, if your term plan has a cover of Rs. 1 Crore and Critical Illness rider cover is of Rs. 30 Lakhs, then on diagnosis of the covered critical illness, Rs. 30 lakhs will be paid over and above the base cover of Rs. 1 crore. Now, after a period of 6 months, you are not able to survive the critical illness, then your nominee will receive the entire base cover amount of Rs. 1 crore. There will be no deduction of the earlier benefit amount of Rs. 30 lakhs already paid to you.

4. Pre-Existing Conditions: You must carefully read the Pre-Existing Conditions excluded under the Critical Illness rider., It is also best to know about the waiting period applied on pre-existing diseases before they are covered.

All in all, you should not be content by buying just a plain and simple basic term plan for yourself. We never know what will happen to us tomorrow or what future has in store for us. It is always better to prepared for whatever we can. The same goes for our protection need. We should always opt for a comprehensive protection than just a basic cover. Ask yourself this, what is best for me and my loved ones?

The Whys And Hows of Choosing A Critical Illness Rider

.jpg)