Choosing the right life insurance plan can be a daunting task. Feeling overwhelmed is a common reaction to having so many alternatives accessible. Two popular choices are Term Life Insurance and Money Back Life Insurance Plans. Each has its unique features and benefits. In this article, we'll delve into the details of these two types of life insurance. We'll compare their coverage, premiums, benefits, and more.

What is Term Life Insurance?

Term life insurance is a kind of life insurance that offers protection for a predetermined amount of time, or term. The insurance may specify a period that is between 10 and 30 years long. The insurer provides the beneficiaries with a death benefit if the policyholder passes away during this term. The primary purpose of Term Life Insurance is to offer financial protection. It does not have a savings or investment component. The premium paid is used solely to secure the death benefit.

Key features of Term Life Insurance include:

- Affordable premiums

- Fixed death benefit

- Coverage for a specific term

- No savings or investment component

- Option to convert to a permanent policy in some cases

- Nothing at maturity if the policyholder lives out the period

- Flexibility in terms of policy term and premium payment options

- Potential for adding riders or additional coverage options

What is Money Back Life Insurance Plan?

A Money Back Life Insurance Plan is a type of life insurance that offers both insurance and investment benefits. It provides coverage for the life of the policyholder and also returns a portion of the premiums paid over the policy term.

In a Money Back Plan, a certain percentage of the sum assured is returned to the policyholder at regular intervals. These are known as survival benefits. If the policyholder survives the policy term, they receive the balance sum assured along with any bonuses. If the policyholder dies during the term, the full sum assured is paid to the beneficiaries, regardless of the survival benefits already paid.

Key features of Money Back Life Insurance Plan include:

- Higher premiums due to the investment component

- Survival benefits paid at regular intervals

- Lump-sum amount upon policy maturity

- Potential for bonuses or additional benefits

- Can be used as a tool for financial planning and saving

- Possibility of loan options against the policy

- Flexibility in terms of policy term and premium payment options

- Potential for adding riders or additional coverage options

Comparing Term Life Insurance and Money Back Life Insurance Plan

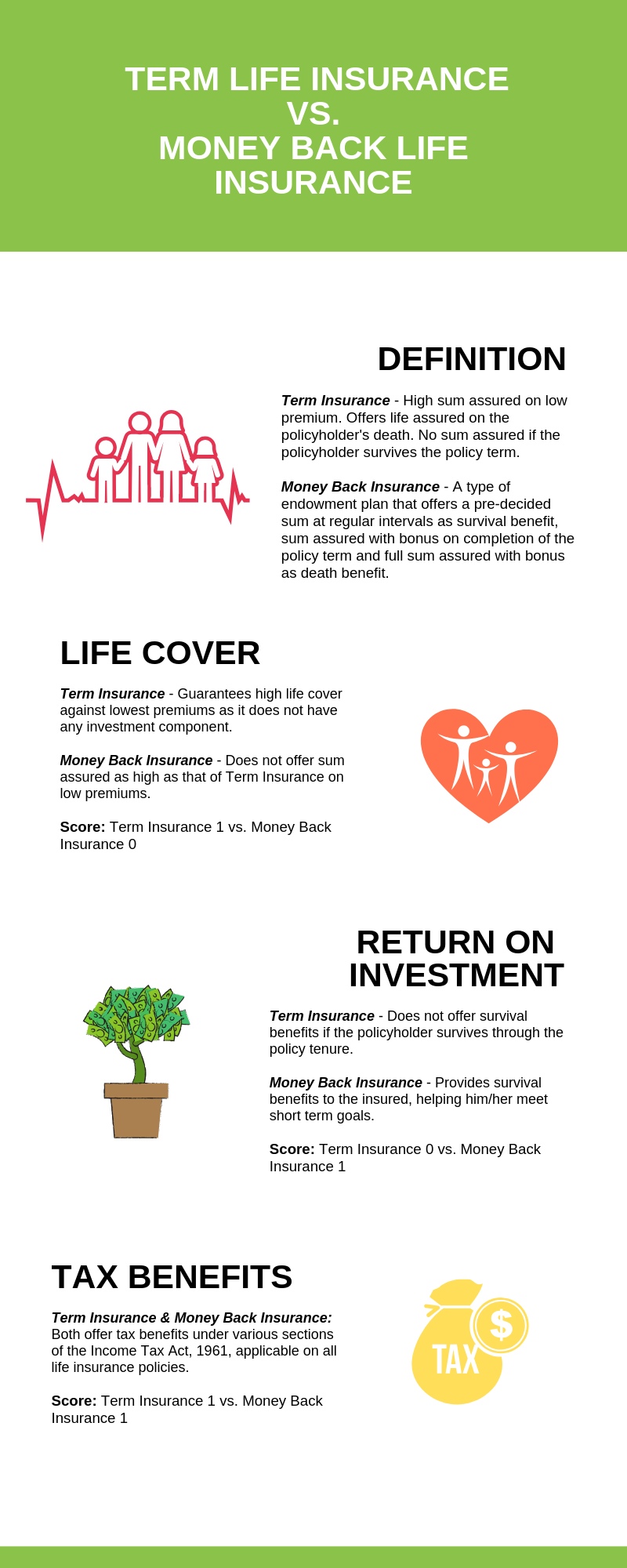

When comparing Term Life Insurance and Money Back Life Insurance Plan, it's important to consider your financial goals and insurance needs. Both types of insurance offer financial protection, but they serve different purposes and come with different features. Term Life Insurance is primarily designed to provide financial protection for a specific period. It's straightforward, affordable, and ideal for those with a temporary need for coverage. On the other hand, Money Back Life Insurance Plan combines insurance and investment, offering both death and survival benefits. It's more complex and generally more expensive, but it can be a useful tool for long-term financial planning and saving.

Key differences between Term Life Insurance and Money Back Life Insurance Plan include:

- Purpose and benefits

- Premiums and payments

- Investment and savings component

- Flexibility and complexity

Coverage and Benefits

Term Life Insurance provides a death benefit if the policyholder dies within the term. There's no survival or maturity benefit if the policyholder outlives the term. Money Back Life Insurance Plan, however, offers survival benefits at regular intervals and a lump-sum amount upon policy maturity, in addition to the death benefit.

Premiums and Payments

Term Life Insurance is generally more affordable, with premiums used solely to secure the death benefit. Money Back Life Insurance Plan has higher premiums due to the investment component. A portion of the premiums is invested, and a portion is returned to the policyholder as survival benefits.

Investment and Savings

Term Life Insurance does not have a savings or investment component. It's purely an insurance product. Money Back Life Insurance Plan, on the other hand, combines insurance and investment. It can act as a forced savings mechanism, with the potential for bonuses or additional benefits based on the insurer's performance.

Choosing the Right Plan for You

Choosing between Term Life Insurance and Money Back Life Insurance Plan depends on your individual needs and financial goals. It's important to consider factors such as your budget for premiums, your need for financial protection, and your long-term financial planning objectives.

Assessing Your Financial Goals

If your primary goal is to secure financial protection for a specific period at an affordable cost, Term Life Insurance may be the right choice. However, if you're looking for a combination of insurance and investment, and you're willing to pay higher premiums for survival benefits and a maturity payout, a Money Back Life Insurance Plan could be more suitable.

Understanding Policy Terms

Understanding the terms and conditions of the policy is important. This includes the policy term, premium payment options, death and survival benefits, investment component, and policy exclusions. It's also important to consider the insurer's reputation, claim settlement ratio, and the potential for policy renewal or conversion.

Conclusion

In conclusion, both Term Life Insurance and Money Back Life Insurance Plan have their unique features and benefits. The choice between the two should be based on your individual financial goals, life stage, and risk appetite.

.jpg)