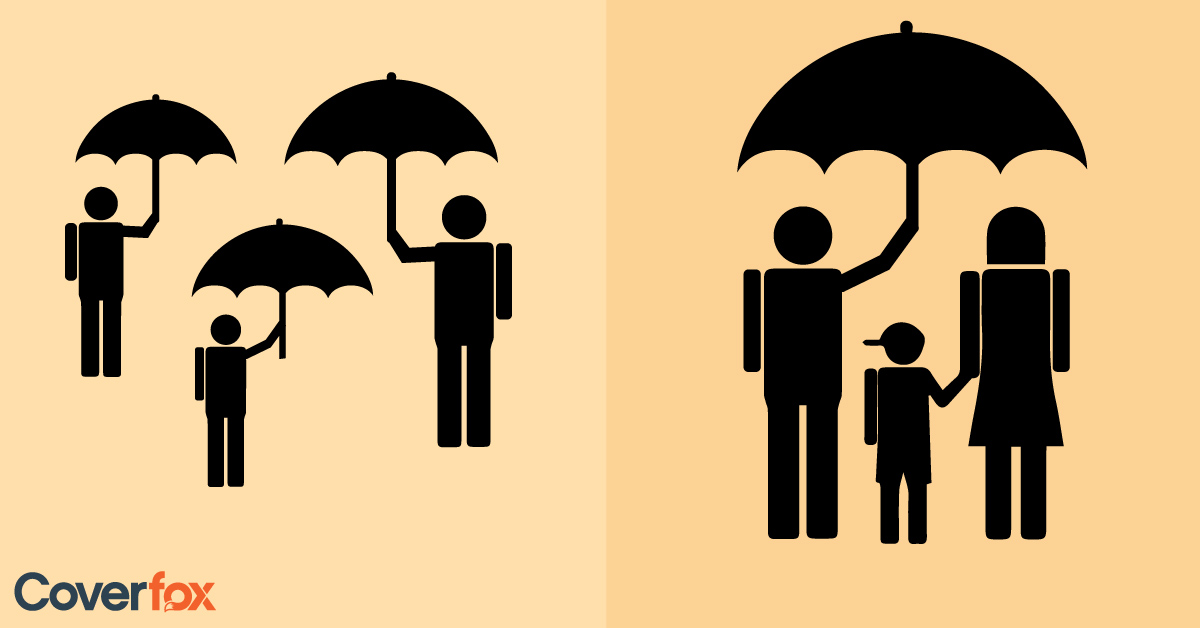

Health insurance is an essential aspect of financial planning, providing coverage for medical expenses in case of illness or injury. When it comes to choosing a health insurance plan, there are two main options: individual health insurance and family floater health insurance.

Individual Health Insurance

Individual health insurance plans provide coverage for a single person. This means that the policyholder is the only one covered under the plan, and the premium is based on their age, health condition, and other factors. The policyholder can choose the sum insured and the coverage benefits according to their needs and budget. Individual health insurance plans are ideal for those who are self-employed, unmarried, or do not have dependents.

Pros of Individual Health Insurance

- Customizable coverage options.

- Premiums are based on individual factors.

- No need to worry about exhausting the sum insured for other family members.

Cons of Individual Health Insurance

- Higher premiums compared to family floater plans.

- No coverage for family members.

- Multiple policies may be required for a family.

Family Floater Health Insurance

Family floater health insurance plans provide coverage for the entire family under a single policy. The sum insured is shared among all family members, and the premium is based on the age of the oldest member. This means that the premium is lower compared to individual plans, making it a cost-effective option for families. Family floater plans are ideal for families with multiple members, as it provides coverage for all family members under one policy.

Pros of Family Floater Health Insurance

- Lower premiums compared to individual plans.

- Coverage for the entire family under one policy.

- No need to manage multiple policies.

Cons of Family Floater Health Insurance

Choosing the Right Plan

When deciding between individual and family floater health insurance plans, it is essential to consider your family's needs and budget. If you have a small family or are single, an individual health insurance plan may be a better option as it provides customizable coverage and premiums based on individual factors. However, if you have a large family, a family floater plan may be more cost-effective and convenient as it provides coverage for all family members under one policy. It is also important to consider the age of the oldest family member. If they are relatively young, a family floater plan may be a good option as the premiums will be lower. However, if they are older, it may be more cost-effective to opt for individual plans for each family member.

Conclusion

In conclusion, both individual and family floater health insurance plans have their own advantages and disadvantages. It is crucial to carefully consider your family's needs and budget before making a decision. It is also recommended to consult with a financial advisor or insurance agent to determine the best plan for your specific situation. With the right health insurance plan, you can ensure the well-being of your family and protect yourself from unexpected medical expenses.

.webp)

in Insurance.webp)