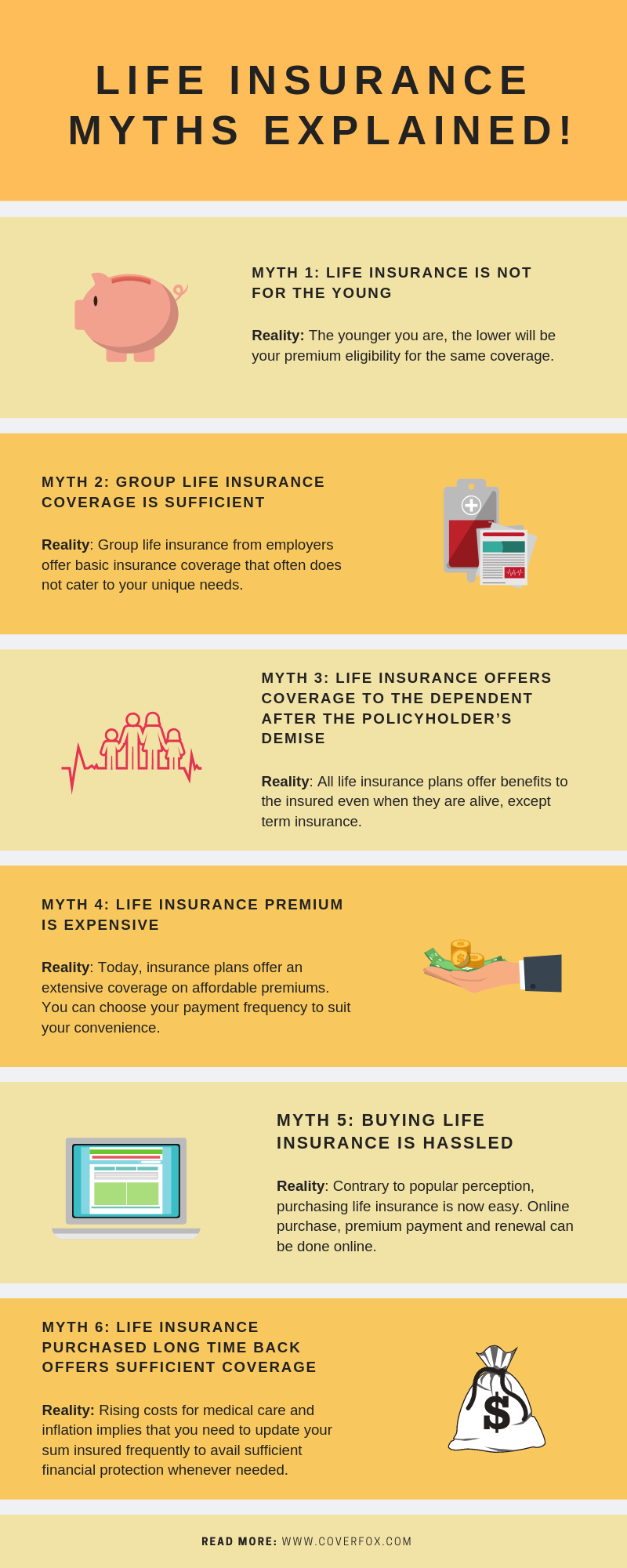

Life insurance is not a glamourous topic and thus it is not discussed enough by people. Thus, making it an easy victim to myths and misperceptions. These myths result in the procrastination while making a decision in buying the most important financial protection of our life. Let’s dig out the common myths associated with a life insurance policy.

Myth: If you are young you don’t need life insurance

We all hear cases of premature and untimely deaths around us. We come across more and more cases of people passing away at a young age. Thus, leaving behind their families in a financial mess in the absence of a life insurance policy. As no one knows when will be their last day it is only sensible to plan a life insurance in the early stage of life.

Myth: My prestigious job comes with a life insurance policy benefit so I am all covered.

Well done if you have a life insurance policy as a part of your perks in your job. However, the cover provided by most employers is fairly basic and it may not cover your actual needs. Also, if you leave your job you have to say adios to your company policy. This leaves you without a life insurance cover and exposed to perils.

Myth: Life Insurance plan will be only useful if I die and since I don’t have a dependent family who relies on me financially, it is of no use to me!

Many people have the belief that as the name suggests life insurance comes to use only if the person dies. It is the biggest myth that life insurance only offers death benefit to nominees. Life insurance which offers only death benefit are term insurance plans but there are also other plans like endowment plans, unit linked plans, money back plans that make payouts on maturity and periodical survival benefits along with bonuses which can be a used as a tool for meeting short term and long term financial savings goals.

Myth: Life Insurance is very costly and I need to grow my income to fund this expense.

Probably this is the vilest myth that keeps people from investing in a life insurance policy. Thus, keeping them and their loved ones sitting ducks to dangerous life situations. Today with little effort and online research you can find term plans which offer a whopping INR 1 crore life cover for under INR 1000 a month for the people between the ages of 25 to 35 age bracket. This is a substantial amount that will keep your family and dependents secure in your absence. Also, there are other plans with lower premiums which you can customize as per your needs and requirements.

Myth: You need to go through a lot of paper work and hassle to get a life insurance policy.

With the boom of internet revolution, all Life Insurance companies have an online presence these days. You can check out the plans on your computer or smart phone and buy the policy by making payment online. The best thing is there is no hassle of paper work, thus making the process easy, convenient and quick. For any assistance, companies have round the clock advisors/experts who will clear your doubts and help you with the process of buying the policy. With help of the growing technology, it has become extremely convenient to buy a life insurance policy today.

Myth: I bought a life insurance policy long back, I am safe and covered.

The only thing constant in life is change while life itself and the world around us changes ever so frequently. The sum assured which you bought years back may not be enough for you now thanks to the term called inflation. Considering an average inflation of 3.22% per year which does not sound too bad until we realize the prices will double every 20 years. This is one of the prime reasons you should review your life insurance portfolio regularly and ensure you have sufficient coverage. Life milestones can also have an impact on your coverage needs. So, it is advised you should review your life insurance portfolio annually and ensure your coverage amount matches your current lifestyle.

For a very important product like life insurance, it is important not to get influenced by the myths. Life insurance should be taken keeping in mind the factual information. Also with the advent of technology, getting information on life insurance online has become very easy. So, now that the myths have been debunked, go evaluate your needs and get yourself financially covered with an ideal life insurance plan.

Here's busting all the myths that surround the concept of life insurance.

Recommended Read: How Much Life Insurance Do I Need?

.jpg)