Two-wheelers have become the most preferred travel option owing to their compactness and performance.

While the vehicle does offer you a hassle-free riding experience, as a responsible owner, it is important to ensure that you don’t miss out on buying it or renewing it on time. As per data released by Insurance Information Bureau, over 60% of two-wheelers plying on Indian roads are uninsured. Non-renewal of two-wheeler insurance can not only make you lose out on financial protection but also land you in legal trouble. Read on to know about the consequences of not having insurance coverage for your two-wheeler vehicle.

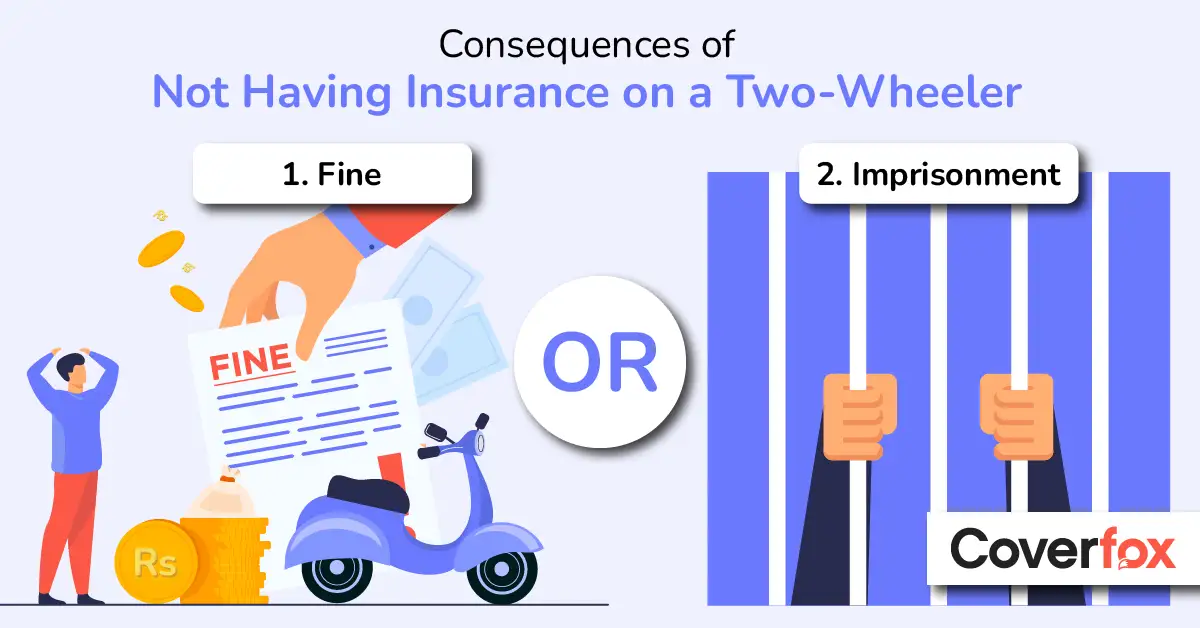

Riding a two-wheeler without insurance cover is a punishable offence

The Motor Vehicles Act, 1988 makes it mandatory for every vehicle owner to own a two-wheeler insurance policy that protects it against third-party damages. Hence, not having third-party cover for your bike can lead to a fine of up to Rs. 2000 or imprisonment of up to 3 months.

Lapse of two-wheeler insurance policy

Not renewing two-wheeler insurance on time leads to policy lapse which means that the insurance company is not liable to pay for the damages caused to a third party or your vehicle. A two-wheeler insurance policy is considered to have lapsed when you do not renew the policy on time i.e. even after the completion of the grace period. The grace period refers to a period of 30 days starting from the date of policy expiry within which the two-wheeler policy can be renewed. In case of any unfortunate event during this period, your lapsed two-wheeler policy will not provide you with any coverage.

Loss of no claim bonus

When you insure your two-wheeler with an insurance company and do not register any claim, the company rewards you with no claim bonus i.e. discount on the premium. This discount can go up to 50% if you don’t make any claim for five consecutive years. However, you will not be eligible to receive an NCB discount if you do not renew your policy on time. In case the policy has lapsed for 90 days or more, you will lose out on the NCB discount. NCB can also be transferred from one two-wheeler insurer to another in case you want to switch your insurer.

Legal liabilities

Third-party bike insurance provides you coverage against damages, death or disability caused to a third-party person or property. Whereas, comprehensive bike insurance coverage provides coverage against damages caused to a third party as well as your bike. In case you are riding a two-wheeler without insurance and meet with an unforeseen accident then you can get into legal and financial trouble. Expenses for all the damages caused will have to be borne by you.

Time-consuming process

Renewal of a lapsed bike policy is a lengthy process. You will have to go through the entire process of purchasing two-wheeler insurance again. Your vehicle will be inspected by a surveyor to check for damages and dents and this may also lead to an increase in premium. Also, you will lose out on NCB benefits and end up paying a higher premium if you renew the policy after 90 days of expiry.

Conclusion

To continue staying covered and avoid financial implications, later on, it is best to avail continued insurance cover for your bike. Purchase and renewal of bike insurance have now become easy due to the advent of technology and you can easily set reminders to renew the policy on time.

in Bikes.webp)

in Bikes.webp)

.webp)