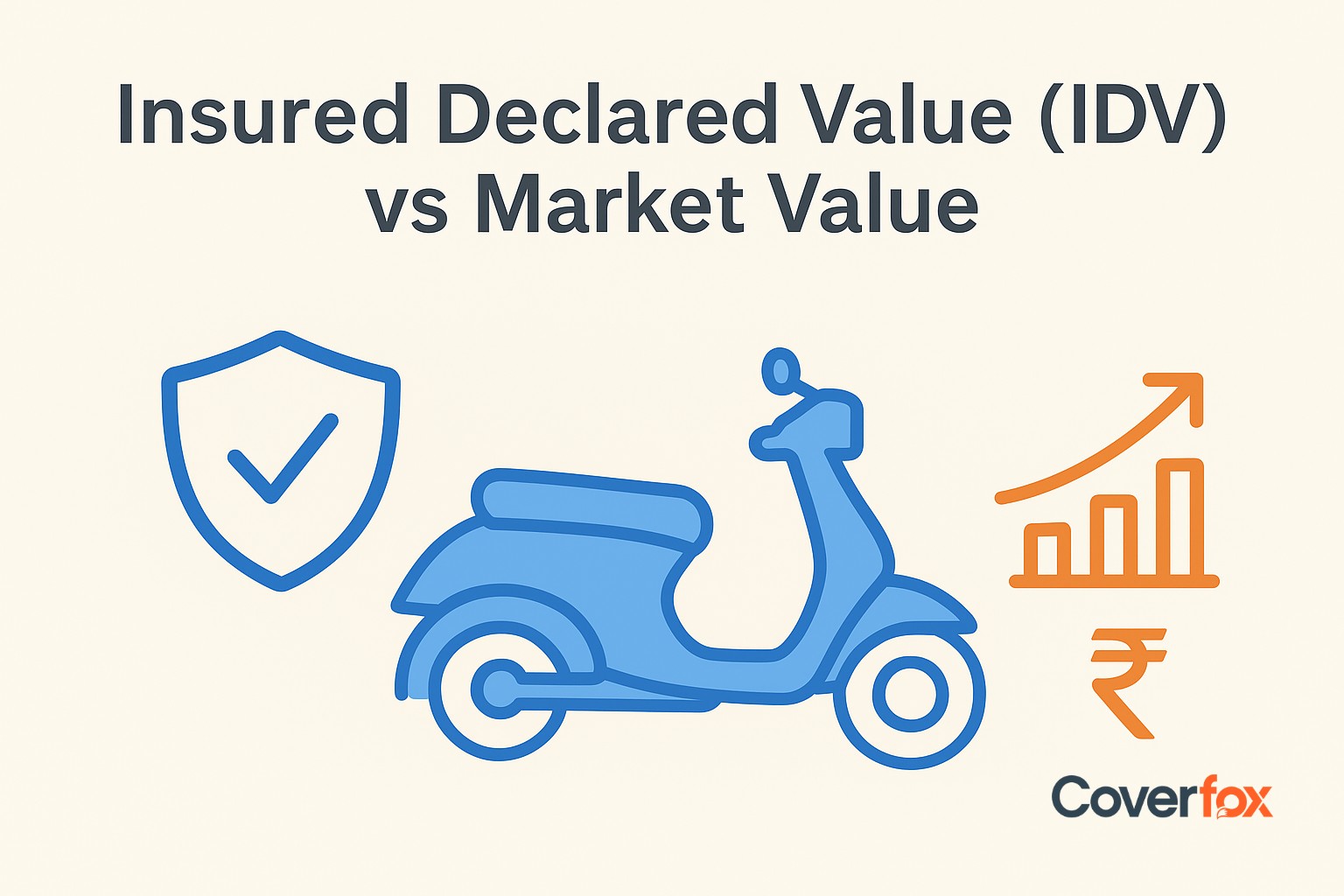

Beyond compliance, it safeguards you against expenses arising from accidents, theft, or damage. However, many owners often get confused between two important terms that define their bike’s value: Insured Declared Value (IDV) and Market Value.

They both indicate the worth of the vehicle, but the difference is that the IDV is the maximum amount the insurer will pay in case of total loss or theft, whereas Market Value refers to the current resale price of the bike in the open market. Owning a two wheeler offers convenience and flexibility in daily travel - but it also requires financial protection. As per the Motor Vehicles Act, 1988, having valid two wheeler insurance is mandatory.

What Is IDV (Insured Declared Value)?

The Insured Declared Value, known as IDV, is the maximum amount your insurance company will compensate if your two wheeler is stolen or suffers total damage. It represents your bike’s present market value after considering depreciation, according to the guidelines set by the Insurance Regulatory and Development Authority of India (IRDAI). The IDV is determined at the time of purchasing or renewing your policy and plays a crucial role in deciding your insurance premium. A higher IDV means better coverage but also a slightly higher premium.

The IDV is calculated following the Insurance Regulatory and Development Authority of India (IRDAI) depreciation schedule. It represents the manufacturer’s listed selling price adjusted for depreciation, not including registration or road tax costs.

What Is the Market Value of Two Wheeler?

The market value of a two wheeler is the estimated price it would gain if sold in the open market today. It reflects the bike’s actual worth after considering factors like age, condition, mileage, wear and tear, and overall usage. Unlike IDV, the market value is not determined by the insurer but by market forces such as demand, model popularity, and resale trends. As a result, the market value often differs from the IDV used for insurance purposes.

IDV vs Market Value - Key Differences

Though both IDV and market value represent your bike’s worth, they serve entirely different purposes in the world of insurance and resale. Understanding how they differ helps you to make smarter decisions while buying, renewing, or selling your two wheeler. Here’s a clear comparison between the two:

| Factor | IDV (Insured Declared Value) | Market Value |

|---|---|---|

| Basis of Calculation | Determined based on the bike’s ex-showroom price minus depreciation as per IRDAI guidelines. | Determined by the current resale price in the open market, considering demand, condition, and age. |

| Usage | Used by insurers to calculate the maximum claim amount in case of total loss or theft. | Used by buyers and sellers to estimate a fair resale price for the vehicle. |

| Impact on Premium | Directly affects the insurance premium, a higher IDV leads to a higher premium. | Does not influence the insurance premium. |

| Depreciation Factor | Calculated using a fixed depreciation rate defined by the IRDAI based on the bike’s age. | Varies depending on market perception, bike condition, and brand reputation. |

| Claim Scenario | Determines the payout amount the insurer will offer during total loss or theft claims. | Indirectly plays a role in claim settlement; relevant only for resale transactions. |

| Control/Determination | Declared mutually by the insurer and policyholder during policy purchase or renewal. | Decided by market trends, buyer interest, and seller expectations. |

| Purpose | Ensures fair compensation during insurance claims. | Reflects the real-world value of the bike for sale or exchange. |

How Is IDV Calculated?

IDV is calculated by taking your bike’s ex-showroom price and reducing it based on its age using the IRDAI’s depreciation schedule:

- 5% for up to 6 months

- 10% for 6 months – 1 year

- 20% for 1–2 years

- 30% for 2–3 years

- 40% for 3–4 years

- 50% for beyond 4 years

The depreciated value represents your bike’s current worth, to which the cost of insured accessories (if any) is added. For instance, if your bike’s ex-showroom price is ₹1,00,000 and it’s 2.5 years old, the IDV would be around ₹70,000 (after 30% depreciation). Adding insured accessories worth ₹5,000 makes the final IDV ₹75,000.

Note: Depreciation rates and valuation methods may vary slightly between insurers depending on internal assessment policies.

Why Does IDV Matter in Bike Insurance?

IDV directly influences your claim settlement and premium cost — it determines the maximum payout if your bike is stolen or completely damaged. Choosing the right IDV ensures fair compensation that matches your bike’s actual worth. If you set a lower IDV to save on premiums, you risk receiving a much smaller payout during a total loss or theft.

On the other hand, setting a higher IDV increases your premium unnecessarily without guaranteeing a higher claim, since insurers settle based on the bike’s real market value. Therefore, selecting an accurate IDV helps maintain the right balance between proper coverage and reasonable premium costs. To find your ideal IDV, you can use an online bike insurance calculator or check your insurer’s suggested range at renewal time.

Role of Market Value in Bike Insurance Claims

In real-world claim settlements, the market value helps insurers assess the vehicle’s actual worth at the time of loss. While the IDV serves as the upper claim limit, the final settlement is usually based on whichever is lower between IDV and market value, as verified by a licensed surveyor. This approach ensures that policyholders receive a fair amount reflecting the true worth of their vehicle at the time of damage or theft, maintaining balance and transparency in the claim process.

Common Misconceptions About IDV and Market Value

Many bike owners often confuse IDV and market value or make assumptions that lead to poor insurance decisions. Misunderstanding IDV and market value can lead to overpaying premiums or underinsurance. Here are some common myths clarified:

- Myth: IDV and Market Value are the same.

Fact: Though both reflect the bike’s worth, they serve different purposes. IDV is used to determine the claim limit, while market value represents the resale price in the open market.

- Myth: A higher IDV always means better coverage.

Fact: A higher IDV increases both your potential claim amount and your premium, but insurers still pay based on the bike’s actual market value at the time of loss.

- Myth: Market value decides the claim amount.

Fact: Insurers compare both IDV and market value during claim settlement and pay whichever is lower, ensuring fair and realistic compensation.

- Myth: IDV stays the same throughout the policy term.

Fact: IDV decreases every year as the bike’s value depreciates with time and usage, and it is recalculated during each renewal.

- Myth: You can declare any IDV you want.

Fact: While you have some flexibility, the IDV must stay within a reasonable range based on IRDAI guidelines, as unrealistic values can lead to claim issues or incorrect premiums.

Importance of Understanding IDV and Market Value for Bike Owners

Understanding the difference between IDV and market value helps every bike owner make smarter insurance choices. It ensures you get fair protection for your vehicle without paying more than necessary. Here’s why it matters:

Informed Policy Decisions

Fair Claim Settlements

Balanced Coverage and Cost

Avoiding Common Misconceptions

Knowing how IDV and market value work allows you to choose the right coverage and set realistic expectations about claim amounts and premium costs.

Awareness of these values ensures you receive compensation that truly reflects your bike’s worth in case of total loss or theft, avoiding underpayment or disputes.

By selecting an accurate IDV, you can strike the right balance between adequate coverage and affordable premiums, ensuring value for money.

Understanding the difference helps you steer clear of myths, such as assuming higher IDV always means better coverage or that market value alone decides claims.

Read More:

FAQs on IDV & Market Value in Bike Insurance

What is the difference between IDV and market value in bike insurance?

IDV is the maximum claim amount set by the insurer in case of total loss or theft, while market value is the estimated resale price of the bike in the open market.

Is IDV the same as the bike’s market value?

No, they are not the same. IDV is used for insurance purposes, whereas market value reflects the real selling price influenced by demand, condition, and usage.

How to know the market value of a bike?

The market value can be estimated by checking current resale listings, consulting dealers, or using online vehicle valuation tools based on model, age, and condition.

Is it possible to increase or decrease the IDV while renewing?

Yes, insurers usually allow minor adjustments to IDV within a permissible range as per IRDAI guidelines during policy renewal.

Why is my bike’s IDV lower than last year?

The IDV decreases every year due to depreciation, as the bike’s value reduces with age and usage.

Does market value affect the insurance premium?

No, insurance premiums are calculated based on IDV, not market value. Market value only helps assess the bike’s real worth at the time of sale or claim.

.webp)

.webp)