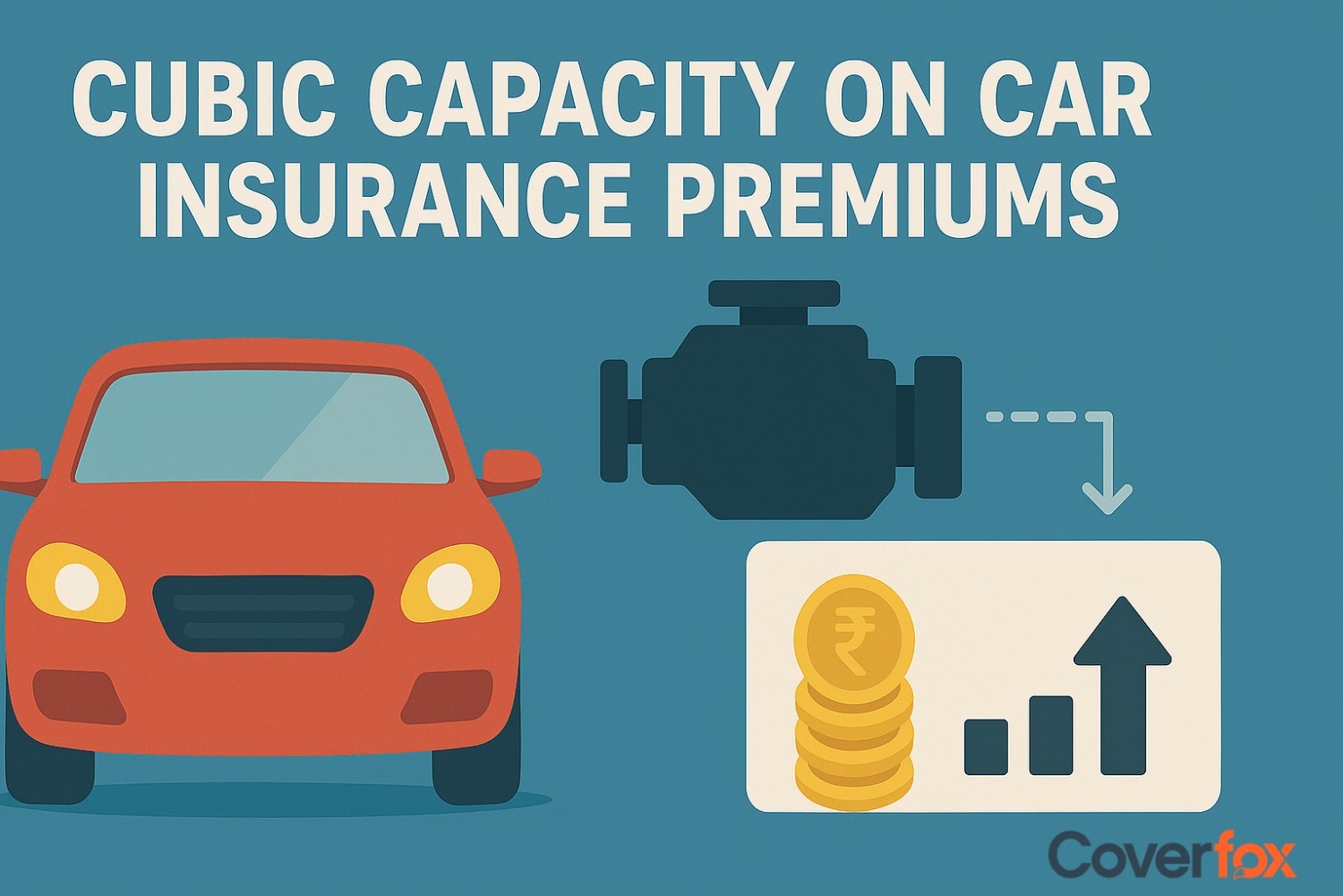

Cubic capacity (CC) is a key factor in determining a car’s insurance premium because it directly reflects the engine’s power, performance and potential risk. Higher-CC engines can reach greater speeds and often involve costlier repairs, leading insurers to place them in higher premium brackets. IRDAI also sets third-party premium slabs based on CC, making it an essential consideration when buying a car.

Understanding the role of cubic capacity is essential when choosing a car and estimating its long-term costs. In the insurance sector, engine size is an important factor used to assess potential risk and premium pricing. This article explains how cubic capacity influences insurance costs and why vehicles with higher engine capacity generally attract higher premiums.

What is the Cubic Capacity (CC) of a Car?

The cubic capacity of an engine, measured in cubic centimetres (CC), indicates the total volume of all cylinders in a car’s engine. A higher CC usually means the engine can burn a greater fuel-air mixture, producing greater power and torque. This directly affects acceleration, top speed, and overall performance, providing a more responsive driving experience. Considering the cubic capacity is crucial when choosing a vehicle, as it helps balance power requirements, fuel efficiency, and long-term maintenance costs.

Role of Cubic Capacity in Insurance Cost Calculation

When calculating car insurance premiums, the engine’s cubic capacity (CC) plays a significant role in risk assessment. Cars with higher engine sizes are generally grouped into higher premium brackets. The Insurance Regulatory and Development Authority of India (IRDAI) itself sets guidelines for third-party premiums based on these CC brackets.

Insurers use a car’s CC in insurance as a key factor to assess risk and calculate premiums.

Vehicles with higher CC can attain greater speeds and may have higher repair costs in accidents, making them riskier to insure.

IRDAI-notified third-party premium rates show slabs such as: private cars up to 1000 cc, between 1000-1500 cc, and over 1500 cc.

Consequently, higher-CC cars often attract higher insurance premiums, while lower-CC vehicles fall into more affordable premium categories.

Why Does Cubic Capacity Influence Car Insurance Premiums?

Cubic capacity plays a key role in premium calculation because it reflects how powerful and potentially risky a car’s engine is. Insurers use CC to estimate the likelihood of accidents, repair costs and overall claim risk.

Higher Engine Power

Costlier Repairs

Greater Accident Severity

Increased Theft Potential

Risk-Based Pricing

Cars with larger CC engines offer stronger performance, which increases the chances of high-impact accidents and raises the insurer’s risk.

Bigger engines generally have more expensive components, making repairs costlier and increasing the expected claim amount.

Higher CC vehicles can reach greater speeds, which may lead to more serious damage during collisions, affecting premium pricing.

Powerful or high-performance cars often attract more theft attempts, which insurers factor into premium calculations.

Since CC directly influences performance, repairability and risk, insurers use it as a core parameter to place the car in the correct premium bracket.

How Cubic Capacity Impacts Different Types of Car Insurance

Cubic capacity affects insurance pricing because it reflects the engine’s power and the overall risk associated with the vehicle. Insurers use CC differently for third-party and comprehensive coverage, making it an important factor in premium calculation.

1. Impact on Third-Party Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) sets the third-party motor insurance premium slabs based on the car’s cubic capacity. Vehicles with higher CC engines are placed in higher premium categories because they are viewed as more powerful and potentially riskier on the road. Here’s how a change in CC affects TP car insurance rates (set by IRDAI).

| Engine Cubic Capacity (CC) | 1-Year Third-Party Premium | 3-Year Third-Party Premium |

|---|---|---|

| Below 1000 cc | ₹2,094 | ₹6,521 |

| 1000 cc to 1500 cc | ₹3,416 | ₹10,640 |

| Above 1500 cc | ₹7,897 | ₹24,596 |

Source - MoRTH

2. Impact on Comprehensive Insurance

While CC influences comprehensive premiums, it is only one of several factors. The car’s age, make and model, repair cost, geographical location, claim history and added accessories also affect the final premium.

How to Lower Premiums for High CC Cars

High cubic capacity vehicles often attract higher insurance premiums because their engines are more powerful and expensive to repair. However, car owners can still manage and reduce these costs by making strategic choices that improve safety, lower risk, and optimise policy benefits.

Ways to Lower Premiums for High CC Cars

Installing advanced safety features such as anti-theft devices, immobilisers, and approved tracking systems reduces risk, which helps insurers offer lower premiums.

Opting for a higher voluntary deductible means you agree to pay a small portion during claims, which decreases the overall premium charged by the insurer.

Maintaining a claim-free year allows you to earn a No Claim Bonus that increases every year, helping significantly reduce the renewal premium even for high CC cars.

Buying car insurance online often provides discounts due to reduced administrative costs and access to transparent comparison options.

Choosing only essential add-ons, such as zero depreciation or engine protection when genuinely required, avoids unnecessary premium load while still maintaining sufficient coverage.

Wrapping Up

A car’s cubic capacity plays an important role in determining third-party liability premiums because higher CC engines are generally more powerful and can cause greater damage in an accident, which increases the insurer’s liability. Owners of high CC vehicles can still manage these costs by practising safe driving habits, installing security features, choosing suitable deductibles, maintaining a claim-free record and selecting only the add-ons that genuinely add value. These steps help keep the overall insurance premium balanced while ensuring proper financial protection on the road.

Explore More Articles:

What Factors Influence Car Insurance Premiums for SUVs and Sedans?

Imported Car Insurance in India: Key Differences, Costs & Coverage Explained

Motor Insurance Types in India: Choosing the Right Coverage

Frequently Asked Questions

What is cubic capacity (CC) in a car?

Cubic capacity refers to the total volume of all the cylinders in a car’s engine. It indicates how much air and fuel the engine can hold and burn at one time. A higher CC generally means more power and stronger performance.

Do higher CC cars cost more to insure?

Yes. Cars with higher CC usually attract higher insurance premiums because powerful engines can lead to greater accident impact and costlier repairs, increasing the insurer’s risk.

Why do insurers consider engine size for premiums?

Insurers look at engine size because it directly affects a car’s speed, power, performance, and potential repair expenses. Larger CC engines can cause more damage in an accident, so premiums are usually higher.

Can I lower insurance on a high CC car?

Yes. You can reduce premiums by installing safety devices, keeping a clean driving record, choosing a voluntary deductible, buying policies online, and selecting only necessary add-ons.

Does CC impact third-party and comprehensive insurance differently?

Yes. CC mainly affects third-party premiums because the charges are fixed by engine bracket. For comprehensive insurance, CC is just one factor, along with the car’s age, model, location, add-ons, and claim history.

Does car type or model matter along with CC?

Yes. Even with the same CC, different models have different repair costs, spare part prices, and safety ratings. These differences influence the final insurance premium.

Do electric vehicles have cubic capacity?

No. Electric vehicles do not have CC because they do not use internal combustion engines. Their premiums are calculated based on battery capacity, motor power, and overall vehicle value.

Do SUVs and sports cars have higher CC and premiums?

Most SUVs and sports cars come with higher CC engines for better power and performance. As a result, their premiums are often higher due to increased repair costs and greater accident risk.