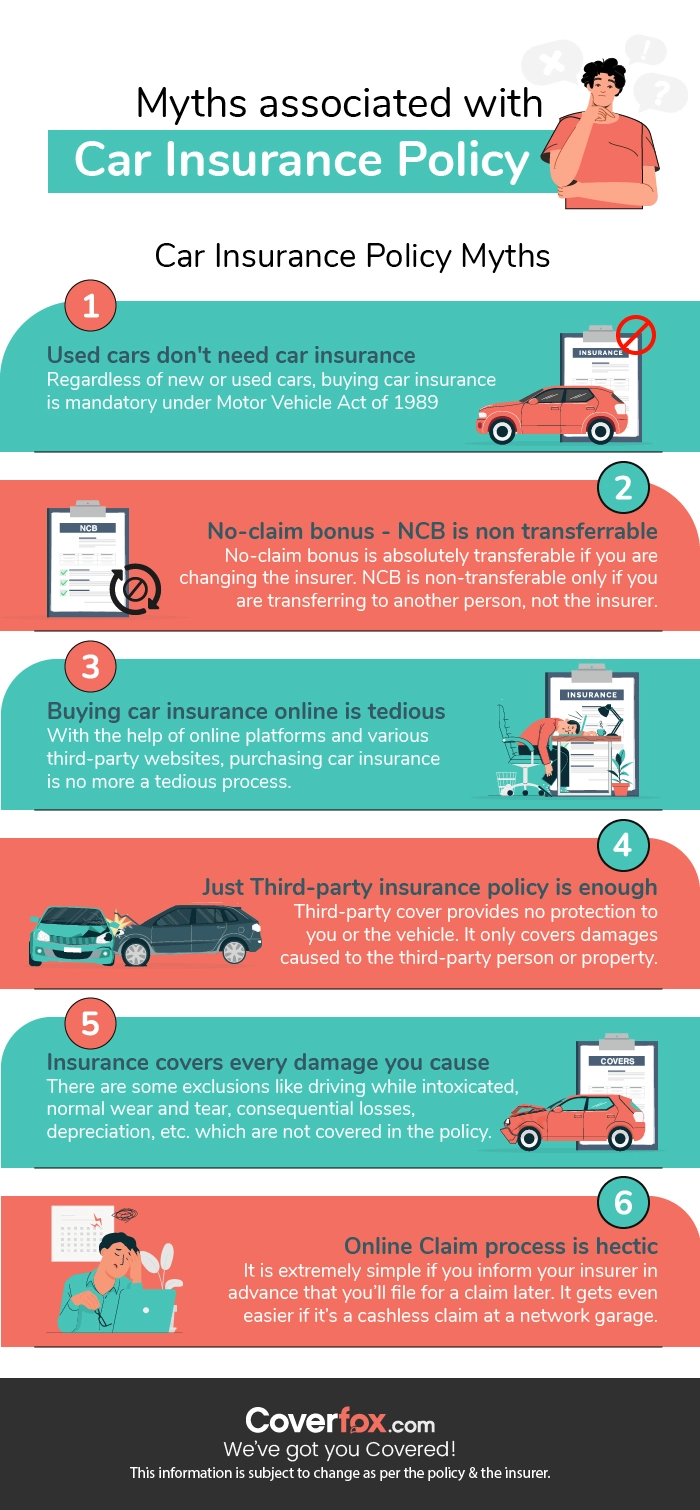

For a first time buyer, car insurance could seem like an awfully intricate subject. On the other hand, if you know the topic as it should be, all myths linked with it can be simply busted.

Sheila was ecstatic about her latest possession – a car. She had just sourced an incredible deal on this used car and was as expected, eyeing for options to insure it with the right insurance plan. However, as she was alien to the matter, was naturally jumbled about picking the right coverage.

On the insistence of few of her friends, she retorted to the online platform and after exhaustive research and comparing quotes from different insurance companies, she succeeded in striking a deal absolutely worth. In this entire course, she was pleasurably surprised at deflating several myths connected with vehicle insurance. Like Sheila, wouldn’t you be just as happy to embrace some first-hand information about vehicle insurance?

Can the colour of your car influence your insurance quote? Find out…

The colour of the car does not matter to anyone except the owner of the car and his astrologer! Yes, we mean it. You may want a specific colour for your car, but to an insurance company, it does not matter.

The fact is that insurers have no interest in the colour of your car except to know if you have been in any car accidents before, the number of miles you drive annually, your profession, where you reside, etc. Though certain colours do push up the cost of the car, it has no other impact. Your insurer would be keener to know the make, model, style, engine size of the car and the type of petrol or diesel that you will have to use.

My car is old, so it won’t be stolen

Really? Here is another myth buster. According to many insurance think tanks, thieves think that an older car is a lot easier to steal than a new car which may be installed with all advanced safety gadgets and alarm, etc. So if you love your car, old or new, just be aware. Be in the safe zone.

Does my age matter?

Actually, the longer you drive with a clean record, you stand to get discount on your car insurance premium. Therefore, drivers over 55 years of age, with an excellent driving history, could qualify for a reduction in auto insurance rates for a stipulated period. Though popular abroad, it is still a novel feature in India. Only HDFC Ergo car insurance offers discounts based on age. It is wise to take guidance on this point from Coverfox customer support expert before you sign on the dotted line. Also, look out for discounts if you are from the forces. Your insurer can be a little more partial to you knowing that you are from the armed forces or a government employee.

When I bought my car, I was automatically covered against all exigencies

Nowadays, car dealers offer you insurance coverage at the time of buying the car. Many a times, this amount is included in the total amount you pay towards your car. However, it’s best to know whether the coverage offered is Comprehensive or Third Party Liability. If it is only Third party Liability cover, then you or your car will not be covered or paid the losses for. Only the Third Party will be beneficial in case of any unfortunate event.

Hence, it’s always advised to opt for a Comprehensive cover where you can select different other beneficial riders like Zero Depreciation cover, Personal Accidental cover, etc. to help you financially, in times required. However, it is recommended that you compare car insurance plans online before purchasing additional covers.

My insurance company can cancel policy

Are you talking about random cancellations? Then ‘no’. But give them a very good reason to cancel, e.g. frauds or non-payments of premium, and your car insurers will then be forced to cancel your policy. But no company can arbitrarily cancel a policy, especially in the middle of a policy term.

If I lend my car, then I am not responsible for any accident. Am I?

Of course you are. Car insurance companies will always hold the owner of the car responsible, and not the driver. You, as a car owner, are completely and singularly responsible for an accident that may happen and for any damages that occur thereon.

Are my personal possessions inside my car covered?

Sorry. No again. Your “Gucci” handbag, your expensive laptop and such items are not covered if your car has met with an accident or is stolen, unless you have taken a recommended add-on cover for personal belongings.

Owners of sports cars pay more insurance

This is a myth again. Though a sports car is a valued, expensive possession and usually not used for daily usage, the only reason insurance premium is costly for this automobile is because of the powerful engine and its engine capacity. Period!

I have a comprehensive policy. Am I fully covered?

It is a myth that if you have ever taken a comprehensive policy, then you will be paid the full claim in case of an accident. You will need to secure yourself through other riders and add-on covers available like zero depreciation, consumables, loss of personal belongings and similar such securities to get complete coverage.

Cashless Tie Ups

You cannot escape payment even if your car insurance company has a cashless tie up. You will have to pay a minimum amount which is a government charge, whenever there is any claim.

Coverfox Wisdom: Get Cover, Get Going

It might take some time while you get all your qualms cleared about the most fitting car insurance policy for you. On the other hand, it’s totally worth it when you actually need to hand-pick one as per your requirements. Coverfox offers a platform where you can compare the quotes from different insurance companies’ basis the add-on features and benefits along with the expert advice. Do call us and save yourself a lot of headaches and pinches in your wallet.