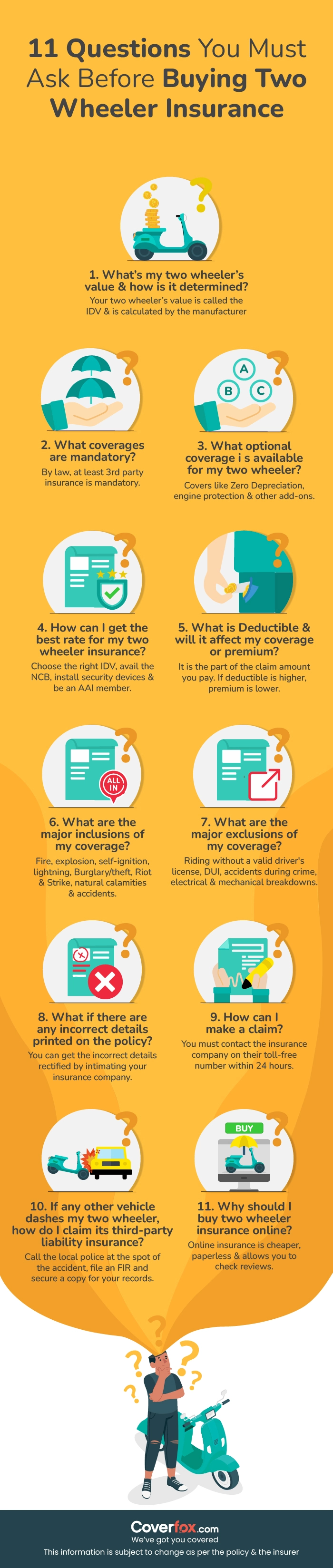

This guide outlines the key questions to ask when buying two-wheeler insurance. It covers the importance of insured declared value (IDV), compulsory deductibles, and types of coverage. A comprehensive checklist is provided, along with final tips on comparing policies and reading policy documents. Secure your financial stability with the right policy.

Navigating the world of two wheeler insurance can be a daunting task. With a myriad of terms and conditions, it's easy to feel overwhelmed.

This article aims to simplify the process. We'll delve into the key questions you should ask before purchasing a policy. From understanding the role of IDV to the impact of compulsory deductible, we'll provide a comprehensive guide. Our goal is to help you make an informed decision about your two wheeler insurance.

Understanding Two Wheeler Insurance

Two wheeler insurance is a contract between you and the insurer. It provides financial protection against damages or losses incurred due to unforeseen events. These events can include accidents, theft, or natural disasters. The insurance policy covers the costs, ensuring you don't bear the financial burden alone.

What is Two Wheeler Insurance??

Two wheeler insurance is a type of vehicle insurance specifically for motorcycles, scooters, and mopeds. It's designed to cover the costs associated with damage or loss of the vehicle. Additionally, it provides coverage for third-party liability. This means if your vehicle causes harm to others or their property, the insurance will cover the costs.

Why is Two Wheeler Insurance Important?

Two wheeler insurance is crucial for several reasons. Firstly, it provides financial protection against unexpected costs arising from accidents or theft. Secondly, in many regions, having valid two wheeler insurance is a legal requirement. Failure to comply can result in hefty fines or penalties.

Key Factors to Consider

When buying two wheeler insurance, several factors should be considered. These factors will influence the type of policy you choose and the premium you pay. Understanding these factors can help you make an informed decision. It can also help you find a policy that offers the best value for your money. Here are some key factors to consider:

- Insured Declared Value (IDV)

- Compulsory deductible

- Types of coverage available

Insured Declared Value (IDV) in Two Wheeler Insurance

The Insured Declared Value (IDV) is the maximum amount the insurer will pay if your vehicle is stolen or damaged beyond repair. It's essentially the market value of your vehicle. The IDV is determined at the beginning of each policy period. It's based on the manufacturer's listed selling price and the age of the vehicle. A higher IDV can result in a higher premium. However, it also means higher coverage in case of total loss or theft.

Compulsory Deductible in Two Wheeler Insurance

A compulsory deductible is the amount you'll have to pay out of pocket for each claim. The insurer will cover the remaining amount. The compulsory deductible is set by the insurance company. It's important to consider this amount when choosing a policy, as it can affect your out-of-pocket costs in case of a claim.

Types of Coverage Available

Two wheeler insurance policies offer different types of coverage. The most common types are third-party liability and comprehensive coverage. Third-party liability covers damages caused to others by your vehicle. Comprehensive coverage, on the other hand, covers damages to your vehicle as well as third-party liability. Understanding the coverage each policy offers can help you choose the one that best suits your needs.

Two Wheeler Insurance Checklist

Before purchasing two wheeler insurance, it's important to have a checklist. This checklist will guide you in making the right decision. Here are some key points to include in your checklist:

- Understand the IDV

- Know the compulsory deductible

- Check the types of coverage available

Questions to Ask Your Insurance Provider

When interacting with your insurance provider, there are certain questions you should ask. These questions will help you understand the policy better. Here are some questions to ask:

- What is the IDV of my vehicle?

- What is the compulsory deductible in my policy?

- What types of coverage does the policy offer?

1. What is the value of my two wheeler and how is it determined?

The value you are referring here is called Insured Declared Value (IDV) which is the maximum amount you’ll be compensated in case of total loss or theft of your two wheeler. The IDV of the two wheeler is calculated by manufacturer's listed selling price and adjusted for depreciation (as per the schedule below). Similarly, the IDV for the accessories which are not factory-fitted is calculated separately, if they need to be included in the coverage at an extra cost.

Depreciation schedule of a Two Wheeler:

| Age Of The Vehicle | % Of Depreciation For Fixing IDV of The Two Wheeler |

|---|---|

| Not exceeding 6 months | 5% |

| Exceeding 6 months but not exceeding 1 year | 15% |

| Exceeding 1 year but not exceeding 2 years | 20% |

| Exceeding 2 years but not exceeding 3 years | 30% |

| Exceeding 3 years but not exceeding 4 years | 40% |

| Exceeding 4 years but not exceeding 5 years | 50% |

Points to remember:

- The IDV has a direct impact on the premium. Higher the IDV—higher is the premium.

- Opting for lower IDV just to save on premium might lead to insufficient coverage amount, in case of a claim.

Final Tips Before Purchasing

Before finalizing your two wheeler insurance, there are a few more things to consider. These tips will ensure you make an informed decision. Firstly, always compare different policies. This will help you find the best deal. Secondly, read the policy document carefully. This will help you understand the terms and conditions.

How to Compare Policies

Comparing policies is a crucial step in buying two wheeler insurance. It helps you find the best coverage at the best price. Look at the IDV, deductible, and coverage types. Also, consider the insurer's claim settlement ratio and customer service.

Reading the Policy Document

Reading the policy document is a must. It contains all the terms and conditions of the insurance. Make sure you understand all the clauses. If you have any doubts, ask your insurance provider for clarification.

Conclusion

Choosing the right two wheeler insurance requires careful consideration. It's not just about the cost, but also about the coverage and the insurer's reliability. Remember, the goal is to secure your financial stability in case of unforeseen incidents. So, make sure you make an informed decision.

in Bikes.webp)

.webp)

.webp)