Ensuring your vehicle gets full protection goes beyond just regular insurance policies. One such often-neglected but critical add-on is the Engine Protection Add-on.

This add-on protects the heart of your car, which is the engine, from certain damage that is not covered by regular insurance. This article discusses the importance, advantages, coverage details, exclusions, and applicability of the Engine Protection Add-on to give you a thorough understanding to help you make informed decisions.

Understanding the Engine Protection Add-on

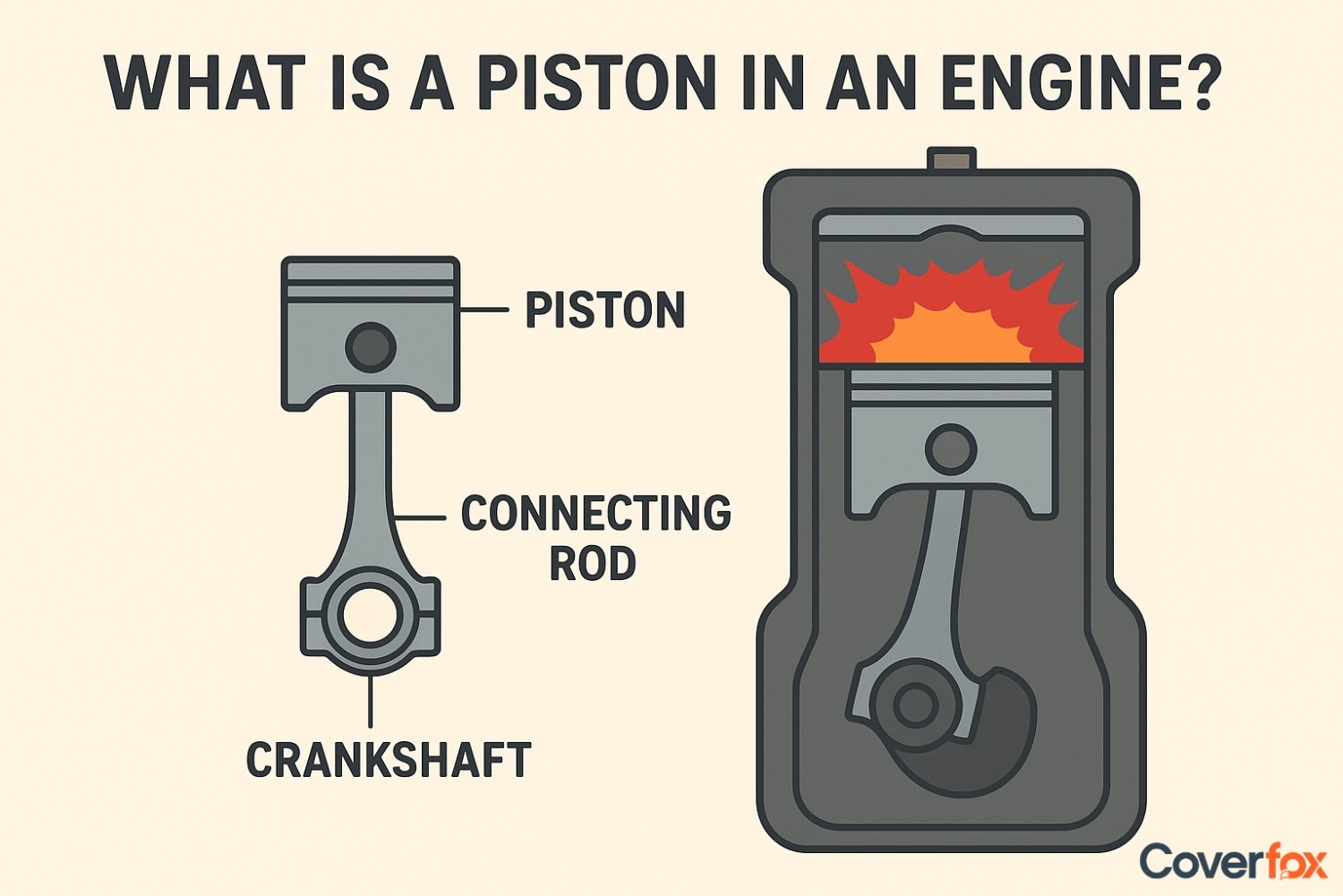

The Engine Protection Add-on is a cover that can be added to your full car insurance policy. It provides financial protection for repair or replacement costs arising from engine damage due to events such as water ingress, oil leakage, or physical damage to the engine components. Such damages are usually not covered by standard comprehensive policies, and this add-on is, therefore, of great importance for additional cover.

How Does Engine Protection Cover Work?

The Engine Protection Add-on is designed to shield car owners from the high costs of repairing or replacing engine components in the event of damage. Standard car insurance policies typically do not cover issues arising from water ingress, lubricant failure, or mechanical breakdowns, leaving owners to bear these expenses themselves. When you opt for the Engine Protection Cover:

Risk Coverage

Claim Process

Repair or Replacement

Financial Relief

It protects your engine against damage caused by floods, waterlogging, or accidental water ingress, as well as oil leakage or other mechanical failures.

If your engine gets damaged, you report the incident to your insurer, submit necessary documents, and have the vehicle inspected by an insurance surveyor.

Once the claim is approved, repairs or replacement of affected engine parts can be carried out at a network garage. Some insurers also offer cashless services, reducing immediate out-of-pocket expenses.

By covering these potentially expensive repairs, the add-on ensures that you do not have to pay large amounts from your own pocket, providing both financial protection and peace of mind.

Importance of Engine Protection Cover

The engine is the most costly part of any vehicle. Replacing or repairing it incurs significant amounts. For example, water seepage during monsoons or oil leakage can stop the engine from working and therefore requires costly repairs. The Engine Protection Add-on avoids such financial losses as it covers such unexpected damages.

Advantages of the Engine Protection Add-on

The Engine Protection Add-on offers car owners more than just insurance; it provides reassurance and financial security against unexpected engine damage. By covering costly repairs and protecting critical engine components, this add-on helps maintain your vehicle’s performance and saves you from sudden financial burdens.

Financial Security

Comprehensive Coverage

Vehicle Longevity

Peace of Mind

It covers the high repair or replacement costs of engine parts, thus saving the customer from significant out-of-pocket expenses.

It includes protection against water ingress and oil leakage, which are not covered under regular policies.

It ensures the timely repair of engine components, thus promoting the overall health and longevity of the vehicle.

It assures potential damage to the engine, especially in areas that are prone to flooding or heavy rainfall.

Coverage Inclusions

The Engine Protection Add-on is designed to protect your car from specific engine-related damages that are typically not covered under a standard policy. The Engine Protection Add-on usually covers the following:

- Damage Due to Water Ingress: This covers the repair cost if water enters the engine due to flooding and the like

- Lubricant Oil Leakage: This covers the damage resulting from the leakage of lubricating oil.

- Gearbox Malfunction: This includes coverage for the repair or replacement of the gearbox due to oil leakage or water ingress.

- Hydrostatic Lock: It includes cases wherein the engine gets damaged because someone tries to start a wet engine and which leads to a hydrostatic lock.

Exclusions to Note

The add-on covers most aspects, but there are exclusions:

- Forceful Starting of a Wet Engine: The damages incurred due to forceful starting of a wet engine are generally not covered.

- Normal Wear and Tear: Standard depreciation and wear of engine parts are not covered.

- Lack of Maintenance: Damage resulting from lack or improper maintenance is not covered.

- Commercial Use: Cars operated on a commercial basis would be excluded from this add-on.

Who Should Opt for the Engine Protection Add-on?

This add-on will best suit owners living in places prone to:

Flooding Regions

Car Owners with New or Luxury Cars

Infrequent Users

Those that experience intense rainfall or floods are their vehicle to have a greater risk of water entering the engine.

Luxury cars require more expensive engine repairs. Extra cover is, therefore, advisable.

Cars kept in the garage for months may develop problems such as oil leakage, which eventually damages the engine.

Things to Keep in Mind When Buying Engine Protection Cover

An engine is one of the most critical and expensive parts of a car. Engine damage due to water ingress, lubricant failure, or mechanical issues can lead to high repair costs. Before purchasing it, car owners should carefully consider the following points to make an informed decision:

Car Age and Eligibility

Coverage Scope

Premium Cost

Network Garages

Claim Process

Policy Terms and Conditions

Car Usage and Risk Factors

Most insurers offer this add-on only for cars up to 3–5 years old. Check if your vehicle qualifies.

Understand what types of engine damage are covered, such as water ingress, lubricant failure, or mechanical breakdown, and what is excluded.

The add-on premium varies based on car model, age, and usage. Compare costs and benefits before finalising.

Verify if repairs under this cover must be done at network garages for cashless claims.

Familiarise yourself with the steps for filing a claim, required documents, and expected timelines to avoid delays.

Read the policy wording carefully to understand limitations, deductibles, and conditions for claim settlement.

High usage, long-distance driving, or exposure to waterlogged areas increase the value of this add-on. Assess your driving habits before purchasing.

How to Buy the Engine Protection Add-on?

Adding the Engine Protection Cover to your car insurance is a straightforward process, but it’s important to make informed decisions before purchasing. This add-on can be included at the time of buying a new policy or while renewing your existing comprehensive plan. To add this add-on:

- Assess Your Needs: Determine your vehicle's risk factors and the cost implications of a potential engine repair.

- Consult Your Insurer: Discuss the add-on with your insurance provider to understand coverage specifics and premium costs.

- Policy Integration: Add the Engine Protection Cover to your comprehensive policy during purchase or renewal.

Claim Process

When your car engine gets damaged, it is important to follow the proper claim procedure to avoid delays and ensure a smooth settlement. By promptly informing your insurer and submitting the right documents, you can get quick assistance and financial support for the repairs. In the event of engine damage:

- Immediate Reporting: Notify your insurer promptly about the damage.

- Documentation: Provide necessary documents, including the claim form, repair estimates, and photographs of the damage.

- Survey and Approval: The Insurance surveyor evaluates damage to settle a claim.

- Repair and Reimbursement: After approval of the claim, repair at a network garage with cashless facilities or obtain reimbursement by sending in bills raised for repairs.

Summary

The Engine Protection Add-on is very important to your car insurance, as it safeguards you financially against sudden engine failures. Understanding the benefits it offers, the scope of protection, and the exclusions will help you make informed decisions to protect your automobile, thus bringing peace and a longer life to it.

Also Read:

Compulsory and Voluntary Excess in Motor Insurance

Is high IDV better in car insurance?

Motor Insurance Types in India: Choosing the Right Coverage

Frequently Asked Questions

What is an Engine Protection Cover?

It is an add-on in car insurance that covers repair or replacement costs of engine parts due to damage.

Do we need engine protection cover in car insurance?

Yes, it is useful as engine repairs are costly and not covered under standard policies.

What is the importance of the engine cover?

It safeguards you from high expenses caused by engine damage due to water ingression, leakage, or lubricant failure.

Is engine protection cover better than zero depreciation?

Both serve different purposes; zero depreciation covers part depreciation, while engine cover specifically protects the engine.

Who should buy the engine protection add-on cover?

It is ideal for owners of new, high-end, or cars prone to waterlogging and frequent use.

Can I buy the engine protection cover after 5 years?

Most insurers offer it only for cars up to 3–5 years old, so availability after 5 years is limited.

What documents are required to buy the engine protection cover in car insurance?

Usually, only your existing car insurance policy and vehicle details are required.