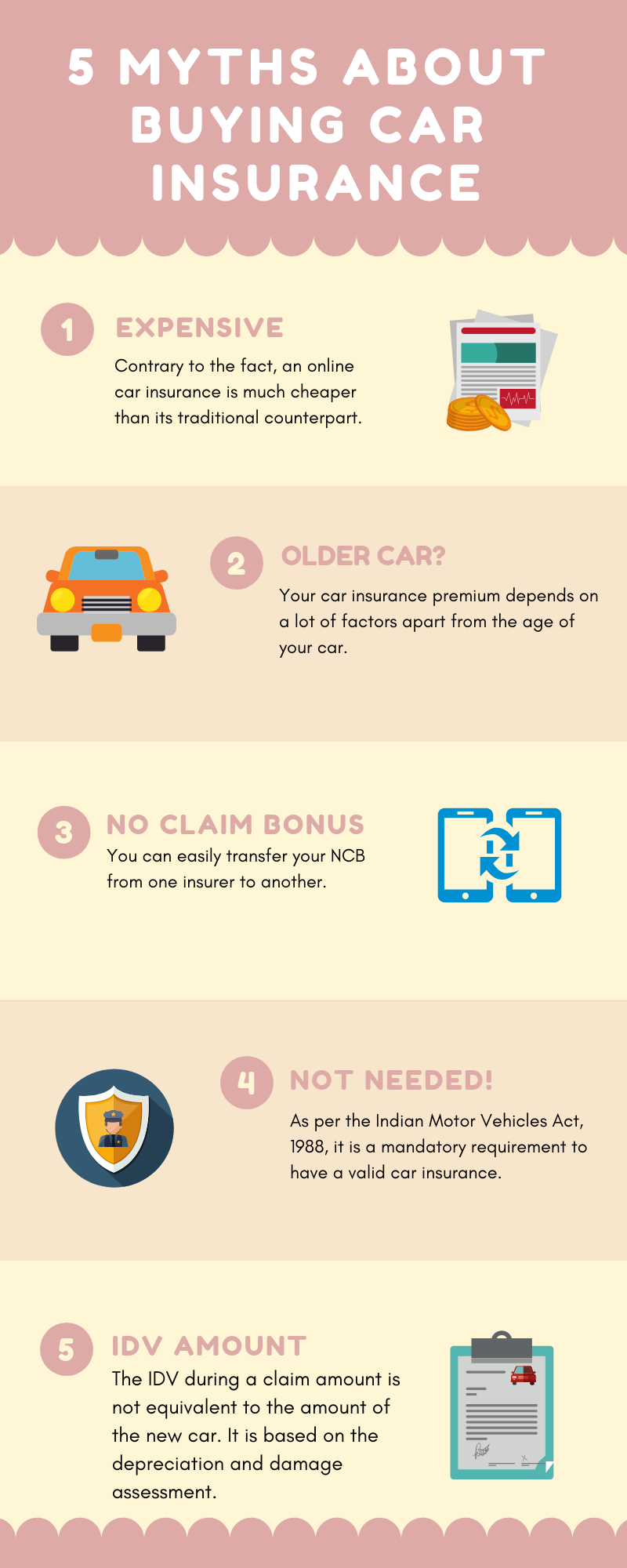

What we hear all the time are not always facts and we get surprised and annoyed on knowing the actual truth. Likewise, there are many misconceptions about car insurance that people have.Let’s bust some of these myths.

Myth: Getting a car insurance policy is a time-consuming and irritating process

Fact: Hurray… if you are reading this article it means you are living in the 21st century internet-revolution era. Thanks to all the brainy heads for creating the technology which has made buying and renewing a car insurance policy a very convenient task. All you need to do is just fill in few basic details about your vehicle. If you are on a comparison website you will see instant quotes from the insurers offering car insurance policy to you. You just have to select the insurer and follow a few easy steps. Voila! You will have your policy in your mailbox in a jiffy. With paperless process gathering momentum these days, getting a car insurance policy has become super convenient and cheaper than getting it offline!

Myth: The older your car is, the cheaper your car insurance premium will be.

Fact: As we hear all the time IDV (Insured Declared Value) is the key to car insurance premium. So, if my car gets older, the IDV will also be reduced which will result in cheaper car insurance. Not always. Your car insurance premiums will depend on manyother things including what kind of coverage you have, your driving record, your age, the kilometres your drive every year and the reason you drive, your claim history, No Claim Bonus(NCB). If you have a high number of claims your premium will not reduce and may even be higher in the next year.

Myth: I will lose my No Claim Bonus if I transfer my policy from one insurer to another

Fact: No Claim Bonus is a reward that the insurance company offers to the policy holder for not making any claim in a year. The good news is that you can transfer your No Claim Bonus from one insurer to another and get the benefits. To retain the NCB you will need to get the new policy within 90 days after your old policy has expired. Beyond 90 days the NCB will not be valid and you will lose the benefit.

Myth: I live in rural India where there is not much traffic and I am an excellent driver. Insurance is of no use to me!

Fact: Dream on Mr. Excellent driver, as per the Motor vehicles act 1988, having a valid car insurance policy for your car is a mandatory requirement in the whole of India. Car insurance also provides you protection even in case of non-accidental damage to your car such as natural calamities like earthquake, cyclone, typhoon etc. In case your car gets stolen or gets damaged due to theft, riots or a terrorist activity then also car insurance provides you coverage. The premium of a car insurance policy is a little price to pay in comparison to the financial loss you will have to bear if you don’t possess one.

Myth: In case of total damage to my car, I will get a claim amount equivalent to the amount of a new car.

Fact: Every insurance policy has an Insured Declared Value (IDV) mentioned in the policy. IDV refers to the maximum sum payable by the insurer for a vehicle at the time of an insurance claim. It is thus the highest amount you can claim in case of total loss or total constructive loss of your vehicle, or in case it gets stolen or damaged beyond repair, within the policy period. So, as the car gets older the IDV is calculated as per the current market price taking depreciation into consideration. So, in case of total damage of the car, you will receive claim which will compensate as per the same financial position your car was in before the damage occurred.

Not knowing the facts can end up costing you a lot of money. So, a word to the wise is always read your policy document carefully and if any doubts get them busted before they bust you!

Also Read: 5 Interesting Facts You Must Know About Car Insurance

5 Common myths about car insurance busted right here! Read on to know more...