With the right two wheeler insurance, you could be covered against theft-related losses. Read ahead to find out the true importance of theft cover in bike insurance.

Imagine this scenario –

You went on a date with your special someone. Since the restaurant didn’t have their own parking space, you chose to park your bike by the road. You had a charming evening - the food was delicious and the dessert made it better.

But once you finished your meal and stepped out towards your vehicle…

“It’s GONE!” Your dear bike was not in its place.

Stolen? Towed away by the traffic police – you don’t know. Just the Horror, the Horror!

Now, this was a hypothetical situation. But what if it really happened to you?

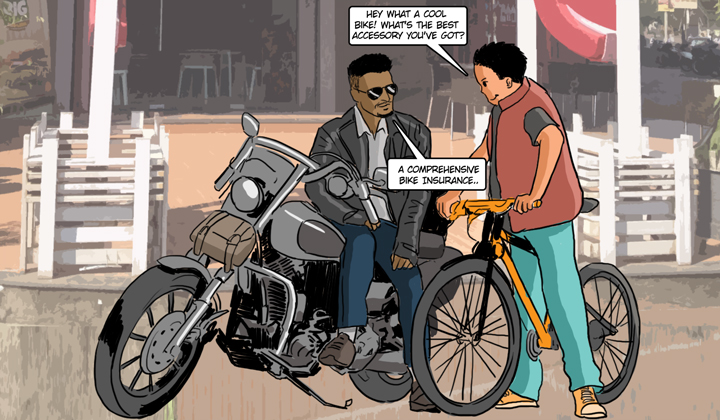

Well, when you have a comprehensive two wheeler insurance plan, you need not fear. Let’s tell you how.

Two wheeler thefts: Stakes are high

The probability of a two wheeler being stolen as compared to a car is pretty much higher. Moreover, compared to stolen cars, the chances of recovering stolen two wheelers is quite low. Why? Perhaps, it’s easier for burglars to dismantle and hide two wheelers.

Bike theft cases on the rise

A report by the Times of India revealed that a vehicle is stolen every 15 minutes in New Delhi. Delhi police revealed that there has been a 13% drop in the number of vehicles recovered. One reason for this is lack of parking space. In Gurgaon alone, at least 3,240 vehicles were stolen and snatched during 2014. This is higher when compared to 3,190 vehicles which were stolen in 2013. Out of these vehicles, around 2,850 were motorcycles and scooters. According to the report, while the number of cases continues to hike, the success rate of them being found by the police remains low at 20-25%. In 2012, Mumbai reported 2,460 two wheelers being stolen while only 720 were recovered.

Secure your asset with yearly investment – Bike Insurance!

Simply having a third-party insurance plan would cover you for third-party liability expenses. Which is the expenses you would be liable to pay had you injured a third party or damaged their property. On the other hand, a comprehensive plan would cover the damage/loss of your vehicle as well as third-party liability.

You can heave a sigh of relief as the theft of your bike would be covered under a comprehensive two wheeler insurance. A little investment each year in the form of premium could help you save up big time especially in such a crisis.

How to make a claim insurance for bike theft?

The moment you realize that it’s a case of theft:

File a FIR

Immediately lodge the First Information Report (FIR) with the police.

Call your insurer

Call your insurance broker or the insurance company directly and file a claim. Provide them with crucial details such as policy number and vehicle details. You would also have to describe details about the incident, i.e. date, time and where it happened.

Inform the RTO

As per law, you have to intimate the Road Transportation Office (RTO) about the theft. After all, they have to give you the RTO transfer papers.

Submit your documents

Once you have finished informing all departments, you need to send the following documents to your insurance company:

- The duly signed claim settlement form

- Original FIR Copy

- Copy of the Registration certificate (RC) of the vehicle

- A copy of the Policy document

- A copy of the driving license

- RTO Transfer papers duly signed

- The original keys of the vehicle

Get the no-trace report

The police will hand over a ‘no-trace report’ declaring that your stolen vehicle could not be located. Note that without this document, the insurance claim on theft of your bike won’t be processed. The police may generate this report one month from the date of the incident. So, you need to be patient and cooperate with them.

The Compensation

Once it has been confirmed that your bike has been stolen and cannot be traced, your insurer may hire a specialist investigator to trace it. These investigations may take up to 60 – 90 days. So don’t despair, but be as calm as possible.

Your insurance would pay up to the IDV that was defined while purchasing your two wheeler insurance plan.

Remember that you can reduce your premium by opting for a lesser IDV. But, it is always recommended to pay a little higher amount of premium and choose an optimum IDV. This will be your savior at the time of making a claim if at all, your bike ever gets stolen in the future. You need to weigh the odds and take a call on choosing the IDV depending on certain factors (like, make & model, CC, etc.). For example, if you reside in a theft-prone area, then opting for a higher IDV is a must.

If your bike was under loan, then the insurance company would reimburse the payout amount to the bank. But, the difference amount would be borne by you.

However, if your two wheeler has been recovered, the insurer won’t pay any claim.

Recommended Read: